A budget surplus happens when money coming in exceeds money going out over a set period. Governments, businesses and households track income and expenses. When revenue is greater than spending, the result is a surplus. When spending is higher than revenue, it’s a deficit. If both are equal, it’s a balanced budget. Many people call a surplus savings because the excess can be saved or invested. Running a surplus often signals efficient financial management and a healthy economy.

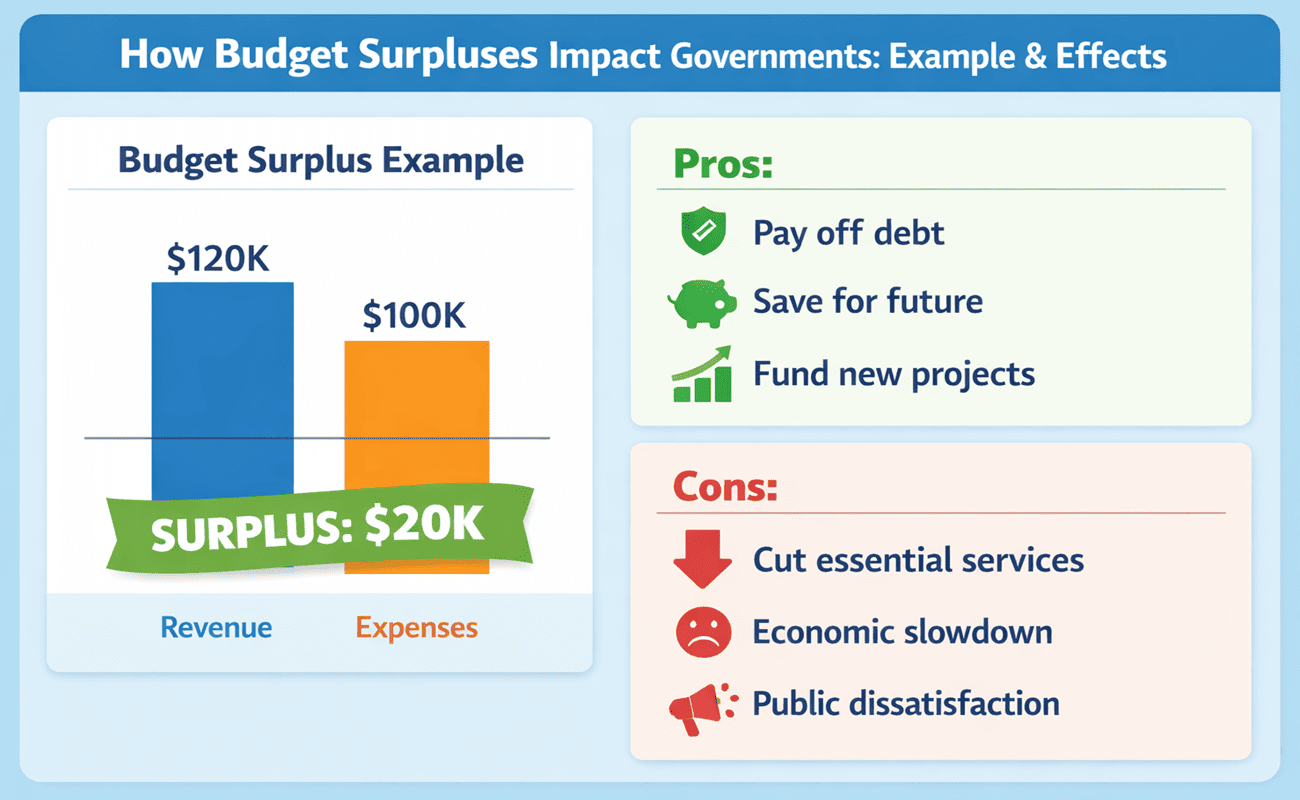

To illustrate, imagine a small country planned to collect 100 thousand USD in taxes and spend the same amount on services. A prosperous year increased tax revenue to 120 thousand USD, while spending remained at 100 thousand USD. The government ended the year with a 20 thousand USD surplus. This extra money can pay down debt, invest in infrastructure or support future spending.

Budget Surplus Vs Balanced Budget Vs Deficit

| Budget Outcome | Revenue Vs Spending | Result |

| Surplus | Revenue > Spending | Extra funds available |

| Balanced budget | Revenue = Spending | No excess or shortfall |

| Deficit | Revenue < Spending | Shortfall that may require borrowing |

In a surplus, money is left over; in a balanced budget, the books breakeven; and in a deficit, the entity must borrow or use reserves to cover costs. Understanding these differences helps individuals and governments plan wisely.

Types of Surplus Budget

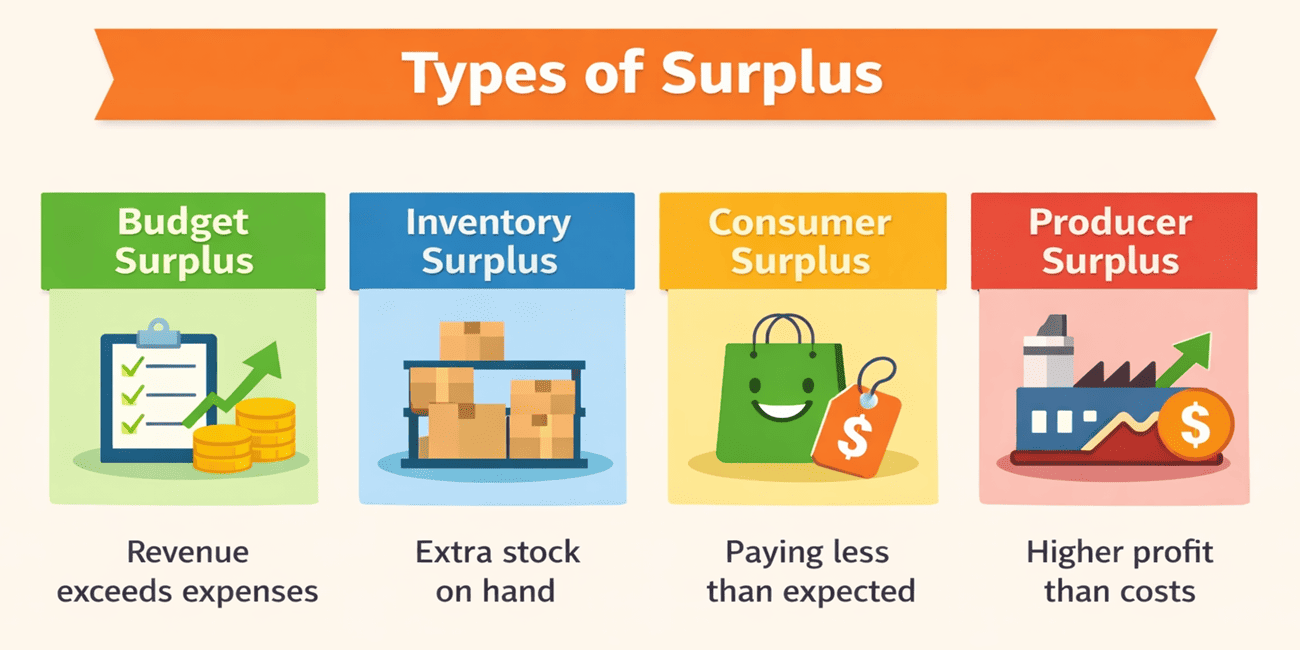

A budget surplus is not the only kind of surplus you’ll encounter in economics. The term also applies to inventory, consumer and producer situations. The infographic below summarizes each type.

- Budget surplus: When total revenue exceeds total expenses for a government, business or household.

- Inventory surplus: Occurs when a company holds more goods than it sells. For example, if a store stocks 100 items but sells only 80, the remaining 20 represent an inventory surplus.

- Consumer surplus: The difference between what a buyer is willing to pay and what they actually pay. If a customer values a product at 20 USD but buys it for 15 USD, the 5 USD difference is consumer surplus.

- Producer surplus: The gap between the lowest price a seller is willing to accept and the price received. If a producer would sell at 12 USD but charges 15 USD, the 3 USD difference is producer surplus.

Knowing these related concepts helps readers appreciate that surpluses exist in many contexts beyond public finances.

Causes of a Budget Surplus

Several factors can lead to a surplus. Economic growth is a major driver; when economies expand, individuals earn more, and businesses make higher profits. This increases tax revenues without raising tax rates. Efficient expense management also matters. Governments and businesses that control waste and streamline operations spend less, freeing money for other uses. Policy decisions such as increasing taxes or cutting spending will often push budgets into surplus, although higher taxes can be unpopular. Commodity prices play a role too. Countries reliant on oil, gas or minerals can see revenues soar during boom years, creating large surpluses. Finally, unexpected one‑time receipts, for example, selling public assets can temporarily boost revenue.

Real‑World Examples and Recent Data

Norway’s surplus: According to the OECD’s Government at a Glance 2025, the average fiscal balance across OECD countries in 2023 was –4.6 % of GDP. Only six member countries recorded a surplus; Norway posted the highest at 16.5% of GDP. High oil and gas revenues combined with prudent spending policies allow Norway to maintain large budget surpluses.

European Union: Eurostat’s 2025 update shows that most EU nations ran deficits in 2024, but there were a few exceptions. Denmark (4.5% of GDP), Cyprus (4.1%), Ireland (4.0%), Greece (1.2%), Luxembourg (0.9%) and Portugal (0.5%) all recorded surpluses. These countries benefited from strong economic growth, fiscal reforms or revenue from high‑performing sectors.

United States monthly surplus: Budget outcomes can swing from month to month. The Bipartisan Policy Center’s Deficit Tracker notes that in September 2025 the U.S. federal government ran a monthly surplus of $164 billion, which was 105 % higher than in September 2024. This unusual surplus resulted from a $124 billion reduction in Department of Education spending after a major federal student loan reform (H.R. 1) and a spike in customs duties. Despite this monthly surplus, the overall fiscal year still ended with a large deficit.

These examples show that surpluses arise under different circumstances: long‑term resource wealth (Norway), solid fiscal management (Denmark) and one‑off policy changes (U.S.).

Pros and Cons of a Budget Surplus

A surplus can be both a blessing and a challenge. The infographic below illustrates some common advantages and disadvantages.

Benefits:

Surpluses provide extra funds that can be used to pay down public debt, reducing interest costs over time. They also offer room for future investment in infrastructure, education or healthcare. In households and businesses, a surplus can increase stability and open doors for new opportunities.

Drawbacks:

Achieving a surplus may require higher taxes or lower spending, which can slow economic growth or reduce essential services. Surpluses can also be misallocated if governments or firms invest poorly, leading to wasted resources. Finally, persistent surpluses may signal that taxes are too high or spending is too low, prompting calls for tax cuts or increased investment.

Managing a Budget Surplus

When extra money appears, thoughtful planning ensures it benefits the community or business. Here are several strategies:

- Pay off debt: Reducing public or corporate debt lowers interest expenses and strengthens balance sheets. Individuals might prioritize paying down high‑interest credit cards or loans.

- Invest in long‑term projects: Surplus funds can build roads, schools, hospitals or new technology. Such investments support economic growth and improve quality of life.

- Build reserves: Setting aside money for emergencies helps governments and families weather downturns. Rainy‑day funds can prevent sudden tax hikes or cuts when revenue falls.

- Adjust taxes or spending: If surpluses persist, policymakers may choose to reduce tax rates or increase spending on needed services. Balanced adjustments keep the economy growing without overheating.

- Encourage private investment: Governments can use surpluses to provide incentives for innovation or small‑business development. Individuals might invest surplus earnings in education or entrepreneurship.

It’s worth asking: What would you do if you suddenly had extra funds? Whether you’re managing a household or a country, intentional choices can turn a surplus into lasting benefits.

FAQs

Q1. What is the difference between a budget surplus and a deficit?

A surplus means revenue exceeds spending, while a deficit means spending exceeds revenue.

Q2. Can a surplus lead to economic problems?

Yes. Large surpluses may come from high taxes or underinvestment, which could slow growth or reduce services.

Q3. How often do governments run surpluses?

Not often. Many countries run deficits. Norway and a few EU nations recorded surpluses in recent years.

Q4. What can individuals learn from a budget surplus?

Keep expenses below income, save or invest the difference, and plan for emergencies.

Q5. Do surpluses affect inflation?

They can. Large surpluses may lower demand if they result from higher taxes or reduced spending, which can ease inflationary pressures.

Conclusion

A budget surplus shows that income exceeds spending during a set period. It reflects careful planning, strong revenue control, and disciplined expense management. Governments and organizations can use a surplus to reduce debt, support growth, or prepare for future risks. Still, a surplus needs smart use to avoid slowdowns or public concern. When leaders balance savings with investment, a budget surplus becomes a powerful tool for long-term stability and sustainable economic progress.