Automated teller machines, or ATMs, changed the way we handle money. Today you can withdraw cash, deposit a check or pay a bill without stepping into a bank branch. Have you ever wondered how those small kiosks became such an essential part of modern banking?

This blog post explains what an ATM is, where it came from, how it works and why it still matters in a world filled with digital payments.

What is an ATM?

An automated teller machine (ATM) is a self‑service banking terminal. It connects to a bank’s network and lets customers perform basic transactions on their own. You insert a card, enter your personal identification number (PIN) and choose a service on the screen. The machine then dispenses cash, accepts deposits, transfers funds between accounts, prints mini‑statements or performs other simple tasks.

These machines are everywhere. According to a 2025 report from Datos Insights’ Global ATM Intelligence Service, the number of ATMs worldwide fell by 2 percent in 2024 to around 2.9 million machines. Cash use is declining, yet millions of people still rely on ATMs for basic banking. Modern ATMs are more than just cash dispensers. Over half of them now accept automated deposits and often recycle the notes inside. This evolution has kept ATMs relevant even as mobile payments grow.

A Brief History of ATMs

The first attempts to automate cash distribution started in the early 1960s. Japanese inventors built simple machines that dispensed cash vouchers when customers inserted special punch cards. In June 1967, Barclays Bank unveiled the world’s first official ATM in London’s Enfield Town. Customers fed a paper cheque into the slot and keyed a four‑digit PIN; the machine then released a set amount of cash.

Throughout the 1970s and 1980s, banks installed ATMs across Europe, North America and Asia. Early machines could only dispense cash. By the 1990s they were connected to global card networks and could process account transfers, check balances and print mini‑statements. In the late 2000s deposit automation arrived, allowing customers to feed notes or checks directly into a machine. Today more than half of ATMs worldwide are deposit‑enabled, and some support recycling, contactless cards, biometric authentication and even QR‑code withdrawals.

Emerging markets continue to deploy ATMs to expand financial inclusion. In 2024, the total number of ATMs fell because large banks in cash‑light economies removed underused machines. Yet independent ATM deployers (IADs) increased their footprint in countries where cash is still king, and banks in regions such as Central and Eastern Europe and parts of Africa added thousands of new machines to serve unbanked communities.

How Does an ATM Work?

An ATM is a small computer with a secure vault and a connection to banking networks. Each terminal includes several key components:

- Card reader and keypad – The reader pulls information from the magnetic stripe or chip on your debit or credit card. The keypad lets you type your PIN and select amounts and services. Always cover the keypad with your hand to keep your PIN private.

- Display screen – Instructions and menus appear on the screen. Some ATMs use touch screens; others rely on side buttons. Follow the prompts to choose withdrawal, deposit, transfer or other options.

- Cash dispenser and deposit slots – The dispenser releases banknotes from a secure cassette. Deposit‑enabled machines have separate slots for cash and checks. They scan and count the money, then credit your account once the bank verifies the deposit.

- Receipt printer and speaker – A small printer generates transaction receipts. Some machines have speakers to relay audible instructions for people with visual impairments. Many modern ATMs let you choose to skip the printed receipt and get a digital notice instead.

- Security measures – Hidden cameras record each session for fraud prevention. The vault within the ATM is reinforced with steel. Networks use encryption to protect transaction data, and banks continually update software to guard against malware.

A typical transaction takes a few steps. You insert your card and enter your PIN. You pick the service you need — cash withdrawal, deposit, transfer or balance inquiry. The machine contacts your bank to confirm that the card and PIN are valid and checks your account balance. If everything matches, the ATM completes the request, dispenses cash or accepts deposits, prints or sends a receipt and returns your card.

Types of ATMs

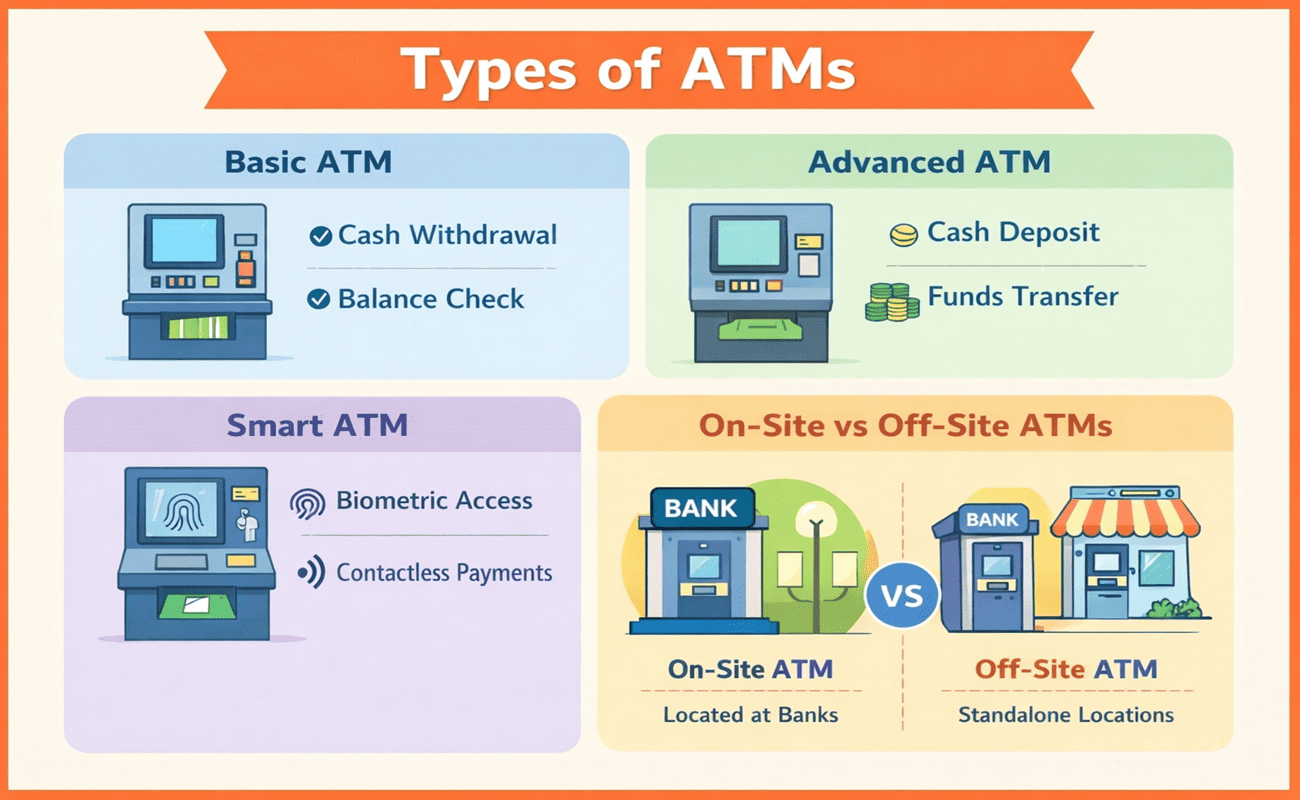

Not every ATM is the same. Machines vary in functionality, ownership and location. Understanding the differences helps you pick the best option for your needs.

Basic Vs Advanced ATMs

- Basic ATMs provide core services such as cash withdrawal, balance inquiries and mini‑statement printing. They may allow you to change your PIN or update your mobile number. These machines are common in smaller branches or at retail stores.

- Advanced ATMs offer additional features, including cash and check deposits, fund transfers between accounts, bill payments and mobile top‑ups. Many advanced machines recycle banknotes; they take in deposits, count the bills and then recirculate them to the next customer.

Smart ATMs

Some banks have introduced smart ATMs with biometric readers, QR‑code scanning and contactless card support. You can withdraw money by scanning a QR code generated by your banking app, use your fingerprint to authenticate or pay bills by tapping your phone. These machines reduce the need for physical cards and make transactions quicker and more secure.

On‑Site Vs Off‑Site ATMs

- On‑site ATMs sit inside or just outside a bank branch. They often have extended functionality because they share infrastructure with the branch. They may accept large deposits or dispense high denominations.

- Off‑site ATMs stand in shopping centers, petrol stations and convenience stores. They provide quick access to cash but sometimes charge a fee if they belong to a different bank.

Services You Can Access with an ATM

Modern ATMs handle more than cash withdrawals. Depending on the machine and your bank, you can complete many everyday tasks:

- Withdraw cash – Choose the amount you need and take money from your account. Some machines let you select your preferred combination of notes.

- Deposit cash and checks – Insert notes or checks into the deposit slot. The ATM counts and verifies the funds, then credits them to your account. Deposited funds may be subject to a holding period until the bank verifies them.

- Transfer funds – Move money between your checking and savings accounts or send funds to another account within the same bank. Make sure to enter the correct account numbers.

- Pay bills – Many ATMs allow bill payments for utilities, phone services or credit cards. You choose the company, enter the amount and confirm.

- Buy mobile top‑ups or reload prepaid cards – Some machines sell airtime or reload stored‑value cards.

- Update account information – Change your PIN, register or update your mobile phone number and print mini statements.

ATM Fees and Limits

Most banks allow a certain number of free ATM transactions each month. After you exceed that limit, they may charge a small fee for each additional withdrawal or deposit. Using an ATM from a different bank often incurs extra costs, which include both a network fee and a charge from your own bank. The fee can range from a fraction of a dinar to several dollars depending on the bank and location.

If you use an ATM abroad, you might pay two kinds of costs. First, the machine operator charges a fixed fee for foreign cards. Second, your bank adds a currency conversion markup. These fees often make international cash withdrawals more expensive than using your card directly for purchases. Check your bank’s terms before you travel, and consider using digital payment methods or travel cards with lower fees.

Banks also set daily withdrawal limits. The limit protects your account if your card is lost or stolen. You can ask your bank to raise your limit, but it depends on your balance, account type and risk profile. Remember that large cash withdrawals may attract attention and might not be safe in public spaces.

Safety Tips for Using an ATM

ATMs are convenient but using them safely requires awareness. Here are some simple tips:

- Choose well‑lit locations – Use machines in busy places or inside bank branches, especially at night.

- Inspect the machine – Look for unusual attachments on the card slot or keypad. Card skimmers are devices criminals attach to steal your card data. If something looks wrong, find another machine.

- Cover your PIN – Use your hand or body to shield the keypad while you enter your PIN. Never share your PIN with anyone.

- Stay alert – Put your cash away before you step away from the machine. If someone offers unsolicited help, politely decline and leave.

- Monitor your account – Check your statements regularly and report any suspicious transactions to your bank immediately.

Future of ATMs

As digital payments gain popularity, the ATM industry is adapting. Banks are adding features that go beyond simple cash dispensing. More than half of the world’s ATMs now accept automated deposits and recycle the banknotes they receive. Smart ATMs offer cardless transactions through QR codes and mobile apps. Biometric verification using fingerprints or facial recognition is appearing in pilot programs. Contactless card readers let you tap your card without inserting it.

Even with fewer machines in operation, the market for ATMs remains sizable. A market analysis estimates that the global ATM industry will grow from US$37.9 billion in 2024 to US$38.88 billion in 2025, a compound annual growth rate of 2.6 percent. Growth is driven by financial inclusion in emerging markets, the need for secure cash services and improvements in technology. Independent deployers are expanding in regions where banks reduce their own fleets, ensuring that people still have access to cash.

Looking ahead, ATMs will probably become multifunctional kiosks that handle cash and digital services. They may act as mini branches where customers can open accounts, print official documents or receive customer support via video chat. As long as cash remains in circulation and people need quick access to funds, ATMs will continue to play an important role.

FAQs

Q1. Why do banks limit ATM withdrawals?

Banks limit daily withdrawals to protect your account from theft and to manage cash in each machine. You can ask for a higher limit if needed.

Q2. What should I do if an ATM swallows my card?

Stay calm. Note the location, time and machine number if visible. Contact your bank right away to report the incident and block the card.

Q3. Can I deposit cash at any ATM?

Not always. Many ATMs accept deposits only for customers of the bank that owns the machine. Look for deposit‑enabled ATMs or visit your bank’s branch for large deposits.

Q4. Are ATMs safe to use?

ATMs are generally safe. Use machines in secure, well‑lit areas, shield your PIN and monitor your account regularly to avoid fraud.

Conclusion

ATMs have come a long way since the first machine in 1967. They remain a vital part of our financial lives, even as mobile apps and online banking grow. You now know what an ATM is, how it works, the different types available, the services it provides and the fees involved. You also learned about safety tips and trends shaping the future of these machines.

If this guide helped you understand ATMs better, share it with friends or family who might find it useful.