A nation’s budget is like a household ledger. If you regularly spend more money than you earn, you rack up debt. Have you ever had to use a credit card to cover an unexpected bill? Countries do something similar when they run a budget deficit. Instead of reaching for a credit card, they issue bonds and other securities to borrow money.

In fiscal year 2025 the United States recorded a federal budget deficit of about $1.8 trillion, equal to roughly 5.9 percent of gross domestic product (GDP). That means the government spent almost two trillion dollars more than it took in from taxes and other revenues. Understanding why this happens and what it means for the economy helps citizens hold policymakers accountable and make informed decisions.

What is a Budget Deficit?

A budget deficit occurs when spending exceeds revenue during a defined period. The U.S. Treasury explains that a deficit arises when the money going out is greater than the money coming in. For the federal government the period is the fiscal year, which runs from October 1 through September 30. When a deficit occurs, the government borrows money by selling U.S. Treasury bonds and bills. This borrowing adds to the national debt, which is the accumulation of past deficits.

The opposite of a deficit is a budget surplus, which happens when revenue exceeds spending. A balanced budget sits between the two, with revenue matching spending. Surpluses have been rare in modern U.S. history; the last year the federal government finished with a surplus was 2001.

It’s important to distinguish between deficit and debt. The deficit is the amount spent above revenue in a single year, while the debt is the total amount borrowed over many years. To cover a deficit the federal government sells securities, and the debt grows as these borrowings accumulate.

Recent Budget Deficit Figures

Deficit figures change from year to year as economic conditions and policy decisions evolve. The table below shows the federal deficit for fiscal years 2023 through 2025. The data come from the U.S. Office of Management and Budget (OMB) and are reported in millions of dollars. For clarity, the amounts are converted to trillions.

| Fiscal year | Deficit (million USD) | Approx. deficit (trillion USD) |

| 2023 | −1,695,240 | 1.70 trillion |

| 2024 | −1,816,790 | 1.82 trillion |

| 2025 | −1,775,357 | 1.78 trillion |

The deficit declined slightly in 2025. It fell by about $41 billion from 2024 (from −1,816,790 million to −1,775,357 million). In relation to the economy, the 2025 deficit equaled roughly 5.9 percent of GDP.

Deficits add to the federal debt. By the end of fiscal year 2025 debt held by the public reached $30.2 trillion. Net debt (debt minus financial assets) stood at $27.4 trillion, and gross federal debt (which includes money owed to government trust funds) rose to $37.4 trillion. These figures underscore how persistent deficits compound over time.

Why Do Budget Deficits Occur?

Several factors explain why a government spends more than it collects.

- Economic fluctuations. When the economy slows, people and businesses earn less, so tax receipts fall. At the same time, spending on unemployment insurance, food assistance, and other safety‑net programs rises. The U.S. Treasury notes that deficits or surpluses are influenced by the health of the economy and by spending and revenue policies. During recessions deficits typically grow because revenues decline and spending increases.

- Structural imbalances. Long‑term commitments to social programs, defense, and interest payments may outpace revenue growth. An aging population increases spending on Social Security and health care, while tax policies enacted decades ago reduce revenue. Without policy changes these imbalances create a structural deficit, a shortfall that exists even when the economy is strong.

- Crisis spending. Exceptional events can cause deficits to spike. For example, the federal deficit more than tripled from $983.6 billion in fiscal year 2019 to $3.1 trillion in 2020 as the government responded to the COVID‑19 pandemic. Stimulus checks expanded unemployment benefits, and loans to small businesses increased spending dramatically. Once the emergency programs ended, the deficit fell but remained higher than pre‑pandemic levels.

- Policy choices. Legislators may decide to cut taxes without cutting spending, or to increase spending without raising taxes. These choices can improve economic well‑being or address pressing needs but also widen the deficit if they are not offset elsewhere.

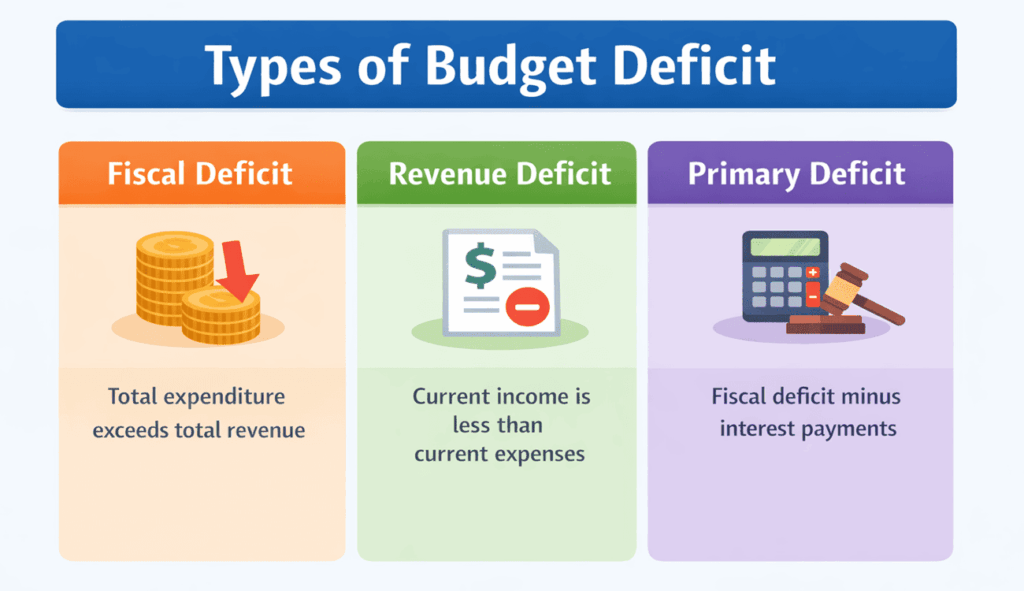

Types of Budget Deficit

Different measures capture different aspects of budget gaps:

Fiscal Deficit

The fiscal deficit is the total amount by which government spending exceeds total receipts in a given period, excluding money borrowed. It reflects the overall gap between what the government spends and what it collects.

Fiscal Deficit = Total Expenditures – Total Receipts (Excluding Borrowings)

Revenue Deficit

The revenue deficit measures the difference between revenue expenditures (such as salaries, subsidies, and interest payments) and revenue receipts (taxes and other recurring income). A positive revenue deficit means the government is borrowing to cover day‑to‑day operations rather than investing in assets.

Revenue Deficit = Revenue Expenditures – Revenue Received

Primary Deficit

The primary deficit equals the fiscal deficit minus interest payments on previous borrowing. It shows how much the government needs to borrow to fund current operations after covering the cost of servicing existing debt.

Primary Deficit = Fiscal Deficit – Interest Payments

Structural Vs Cyclical Deficits

Economists also distinguish structural deficits, which persist even when the economy is operating at full capacity, from cyclical deficits, which arise during downturns and disappear when growth resumes. Structural deficits suggest a mismatch between long‑term revenues and expenditures, while cyclical deficits reflect temporary economic conditions.

Economic Effects of Budget Deficits

A budget deficit can influence an economy in both good and bad ways. The impact depends on the size, duration, and use of borrowed funds.

Inflation and Interest Rates

Large deficits may increase the amount of money circulating in the economy. If supply cannot keep up with demand, prices may rise. Central banks can counteract inflation by raising interest rates, but higher rates also make borrowing more expensive for households and businesses. Persistent deficits may lead investors to demand higher interest rates on government bonds, increasing the cost of servicing debt.

Crowding Out and Investment

When the government borrows heavily, it can compete with the private sector for funds. This crowding‑out effect might reduce private investment, slowing economic growth. However, if borrowed money finances productive investments, such as infrastructure, education, or research; future growth can offset the costs.

Exchange Rates and Debt Sustainability

Deficits can affect a country’s currency. Heavy borrowing may weaken the currency if investors fear inflation or default. On the other hand, a deficit financed by foreign investment can strengthen a currency in the short term. Long‑term sustainability depends on whether the economy grows faster than the debt. If debt grows faster than the economy, a country may struggle to pay interest without cutting essential services or raising taxes.

Balanced View

Deficits are not inherently bad. During downturns, they can stabilize the economy by supporting incomes and spending. When used wisely to build infrastructure or improve human capital, they can enhance future prosperity. Problems arise when deficits persist without a plan to restore balance. By looking at both the benefits and the risks, policymakers can make prudent choices.

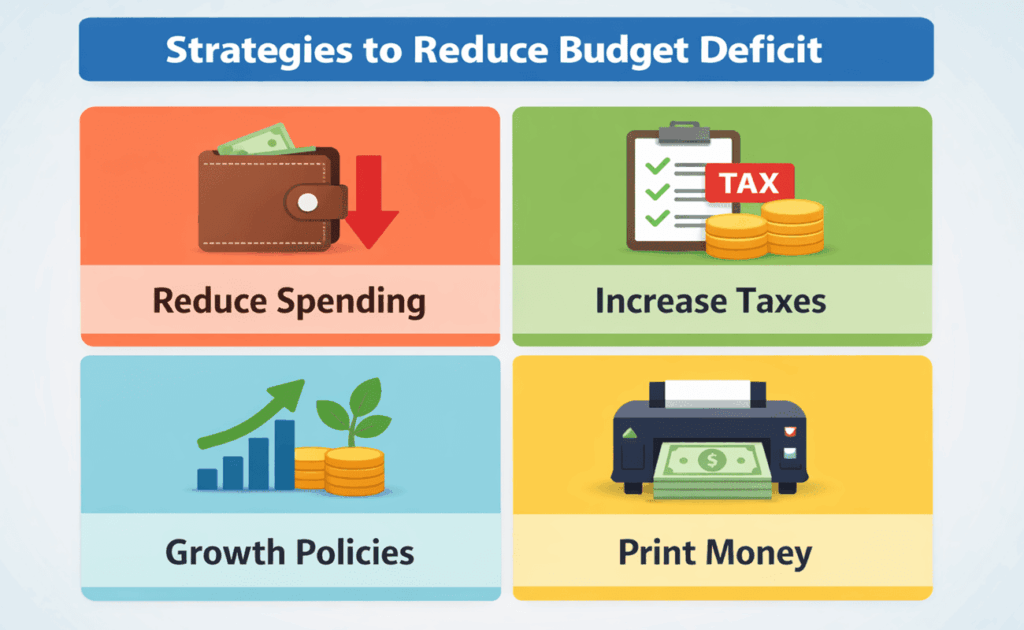

Strategies to Reduce Budget Deficits

Reducing a deficit requires a combination of spending restraint and revenue measures.

There is no one‑size‑fits‑all solution, but the following strategies often appear in public debates:

- Cut Spending. Governments can lower deficits by reducing outlays on programs, subsidies, and administrative costs. Careful spending reviews can identify waste, prioritize essential services, and postpone or cancel lower‑priority projects. Political will is critical because every program has supporters.

- Raise Taxes or Broaden the Base. Increasing tax rates, closing loopholes, or expanding the tax base can boost revenue. Changes to tax policy should balance equity and growth. For example, eliminating unnecessary tax breaks may raise revenue without discouraging productive investment.

- Promote Economic Growth. Policies that encourage investment, innovation, and employment expand the tax base and reduce the need for safety‑net spending. Examples include investing in infrastructure, improving education, streamlining regulations, and attracting foreign investment.

- Print Money Carefully. In extreme cases, governments may finance deficits by issuing new currency. While this can be a short‑term fix, it carries a high risk of inflation and currency devaluation. History shows that printing money without underlying economic growth erodes purchasing power and can lead to a loss of confidence.

The best approach often combines these strategies. A government might reduce waste, reform taxes, and implement growth‑friendly policies while avoiding overreliance on money creation.

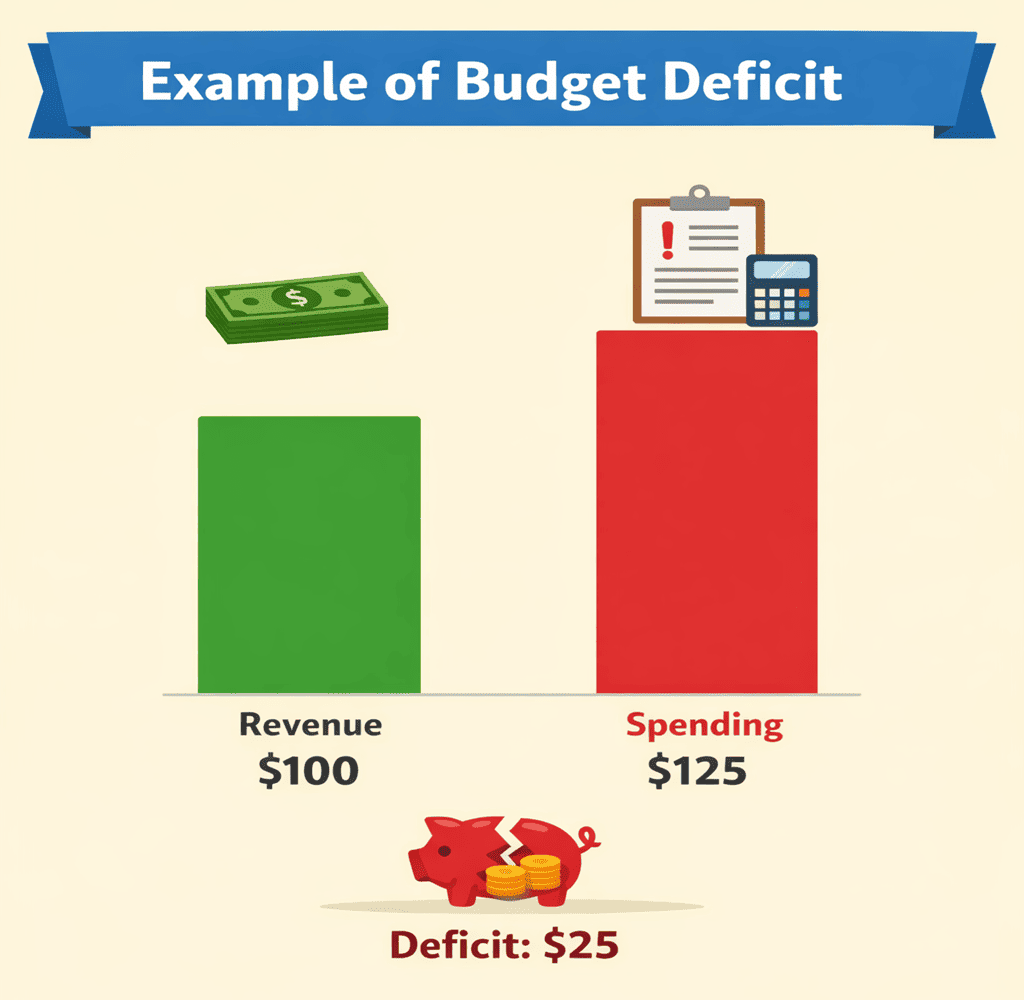

Example of a Budget Deficit

Imagine a small country plans to collect $100 million in revenue but spends $125 million on roads, schools, and salaries. The difference $25 million is the budget deficit. To cover this gap, the country may sell bonds to investors and promise to pay them back with interest. The bonds increase the national debt, and next year’s budget will need to include interest payments.

This simple example mirrors the way national budgets work. When spending consistently exceeds revenue, deficits accumulate and add to the public debt. Policymakers must decide whether the benefits of extra spending justify the costs of borrowing.

Policy Measures and Reforms

Beyond broad strategies, specific policy tools can help manage deficits:

- Entitlement reform. Adjusting eligibility, benefits, and indexing formulas for programs like Social Security and Medicare can slow spending growth without eliminating benefits. Changes should be gradual to give people time to adjust.

- Tax reform. Simplifying the tax code, closing loopholes, and ensuring that everyone pays their fair share can raise revenue and reduce economic distortions.

- Spending caps and fiscal rules. Some countries adopt laws that limit annual spending or deficits. Well‑designed rules provide flexibility during recessions but enforce discipline over the long term.

- Transparency and accountability. Publishing clear budget information and engaging the public in budget debates builds trust and helps set priorities. When citizens understand trade‑offs, they can hold leaders accountable.

Are Budget Deficits Always Bad?

Deficits are tools. Used wisely, they can cushion a recession, finance needed investments, and spread the cost of large projects over the generations that benefit from them. During the pandemic, large deficits kept households and businesses afloat.

But deficits also carry risks. Large and persistent deficits can push up interest rates, weaken a currency, and crowd out private investment. If debt grows faster than the economy, servicing that debt may require painful cuts or tax increases. History shows that countries that manage deficits prudently and invest in growth enjoy more stable economies. Those that ignore deficits face crises.

So are deficits always bad? The answer depends on context. In a downturn a deficit can be a lifeline; during a boom it may be a warning sign. The key is to align borrowing with long‑term goals and maintain a sustainable path.

FAQs

Q1. What is a fiscal deficit?

The fiscal deficit is the shortfall between a government’s total spending and its total receipts, excluding new borrowing. It shows how much must be borrowed to fund current policies.

Q2. How does the government finance a budget deficit?

It borrows by issuing Treasury bonds, notes, and bills. Investors lend money in exchange for a promise of future repayment with interest. This borrowing adds to the national debt.

Q3. Can printing money eliminate the deficit?

Printing money can cover short‑term gaps but risks rapid inflation and currency devaluation. Without matching economic growth, creating new money reduces the purchasing power of existing money.

Q4. What is the difference between a budget deficit and the national debt?

The deficit measures the annual gap between spending and revenue. The national debt is the accumulation of past deficits minus surpluses and reflects how much the government owes in total.

Q5. Are budget deficits always harmful?

No. Deficits can stimulate growth during recessions or finance investments that pay off later. Problems arise when deficits persist without a plan to stabilize the debt relative to the size of the economy.

Conclusion

A budget deficit simply means that spending exceeds revenue. It is neither a badge of shame nor a badge of honor. Like a mortgage, it can help finance worthwhile projects when used responsibly. But, as any family knows, borrowing without a plan leads to trouble.

As you read headlines about trillions of dollars and political debates, remember the basics: deficits grow when the economy slows, when policy choices reduce revenue or raise spending, or when unexpected crises strike. They can support recovery and investment, but they also add to the debt that future generations must repay. Being informed is the first step toward a healthier fiscal future.