Are you launching a new venture and wondering whether to remain a company or become a corporation? Understanding the difference between a company and a corporation helps you choose the structure that aligns with your goals.

This blog post defines each term, highlights their differences and offers practical advice for entrepreneurs and small‑business owners.

What is a Company?

A company is a broad term for any organization engaged in commercial or professional activities. It can refer to a sole proprietorship run by one person, a partnership owned by two or more individuals, a limited liability company (LLC) or a corporation registered with a state. Many small businesses start as sole proprietorships or partnerships because they are easy to set up and give the owners full control.

In these forms the company is not separate from the owner, so business debts and legal claims can attach to personal assets. When the business registers as an LLC or corporation it becomes a separate legal entity with its own rights and obligations.

Example: Monica operates a small home‑baking business. She sells cakes at local markets and files her business income on her personal tax return. Because she hasn’t registered a separate legal entity, her business is a company in the broad sense but not a corporation. She may register an LLC later for liability protection.

What is a Corporation?

A corporation is a specific legal structure recognized by state law. The U.S. Small Business Administration explains that a corporation (often called a C corporation) is a legal entity separate from its owners and “can make a profit, be taxed and be held legally liable”. Owners of a corporation are shareholders who elect a board of directors to oversee major decisions. Because the corporation exists separately from its shareholders, their personal assets are usually protected from business debts or lawsuits. Corporations can raise money by issuing stock and can continue operating even if shareholders leave or sell their shares.

Corporations also face more formal requirements. The board must follow state corporate laws, keep extensive records and file annual reports. They pay corporate income tax on profits, and those profits may be taxed again when distributed as dividends to shareholders. Some corporations elect S corporation status with the Internal Revenue Service to avoid double taxation, but they still follow corporate formalities.

Example: When GreenTech Innovations wanted to attract venture capital funding for its renewable energy projects, it incorporated. Investors bought shares in the corporation, and the company could issue stock options to employees. The corporate structure gave investors confidence because their risk was limited to the amount they invested.

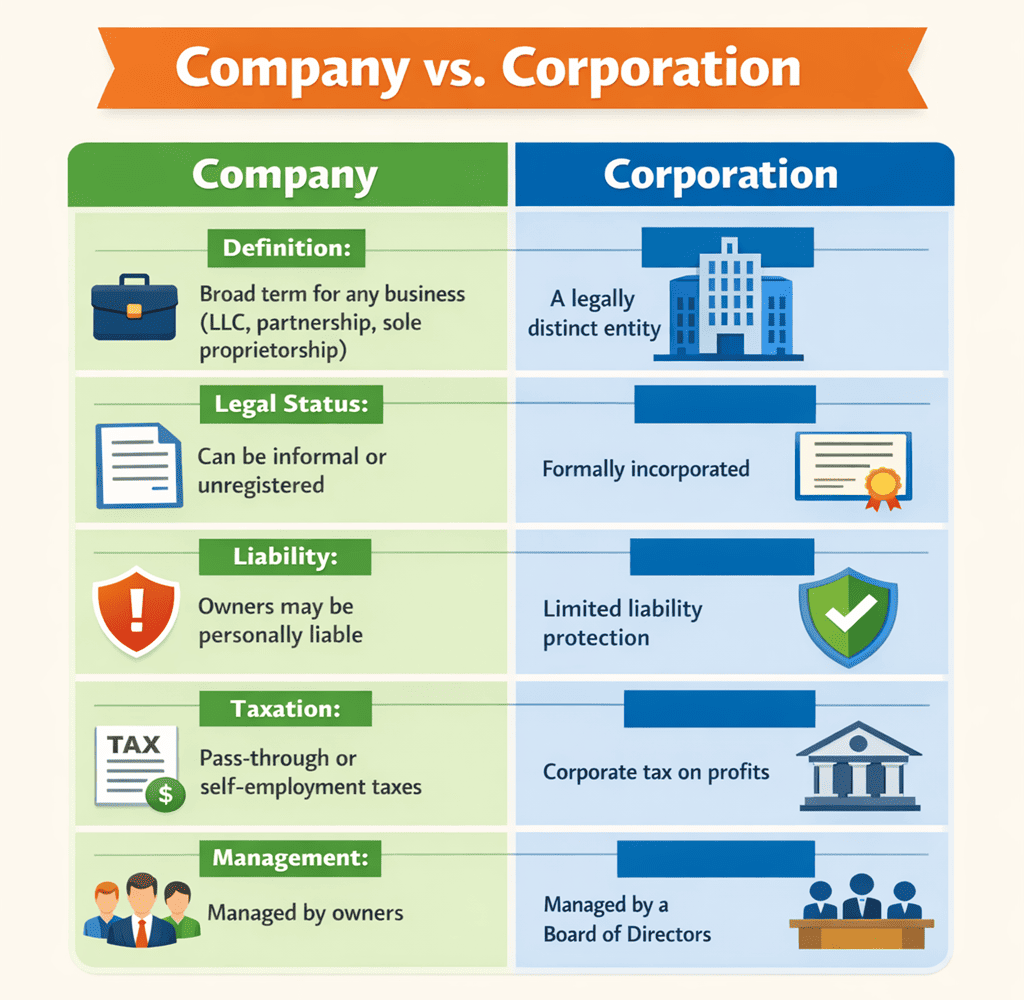

Key Differences Between Companies and Corporations

Understanding the distinctions between a company and a corporation helps you decide which path suits your business. Below are the major differences:

Definition and Scope

The term company covers every business entity, from a one‑person freelance practice to large public firms. A corporation is just one type of company—a specific legal entity created by filing articles of incorporation with a state authority. Every corporation is a company, but not every company is a corporation.

Legal Status and Liability

Unregistered businesses like sole proprietorships and general partnerships do not create a separate legal entity. The owner and the business are the same, so creditors can pursue personal assets to satisfy business debts. By contrast, a corporation is a distinct legal person; it can own property, sign contracts and sue or be sued. Shareholders typically enjoy limited liability, meaning they are not personally responsible for corporate debts beyond their investment.

Ownership and Management

In a small company the owner usually manages day‑to‑day operations. Partnerships divide management among partners according to their agreement. An LLC offers flexibility; members can manage the company themselves or appoint managers. A corporation has a board of directors elected by shareholders to make major decisions and officers who handle daily operations. Shareholders can buy or sell stock without affecting the corporation’s existence.

Taxation

Companies that are not corporations typically use pass‑through taxation. Profits pass directly to owners, who report them on their personal tax returns. Corporations generally pay corporate income tax on profits; when they distribute dividends, shareholders pay personal income tax on the same money, resulting in double taxation. S corporations avoid this double tax by passing profits and losses through to shareholders, but they must meet IRS eligibility rules.

Formation and Formalities

It is simple to start a sole proprietorship—no state filing is required, and the business operates under the owner’s name. Forming an LLC or limited partnership requires filing articles of organization or a partnership certificate. To create a corporation, the founders must name the business, choose the state of incorporation, draft articles of incorporation and file them with the secretary of state, appoint a board of directors and select the corporation’s tax status. Corporations must hold regular meetings and keep formal records.

Raising Capital and Growth

Companies with informal structures often rely on personal funds or bank loans. LLCs may attract small investors but usually cannot issue stock. Corporations can issue shares to raise large amounts of capital. This ability makes them attractive for high‑growth ventures and businesses planning to go public.

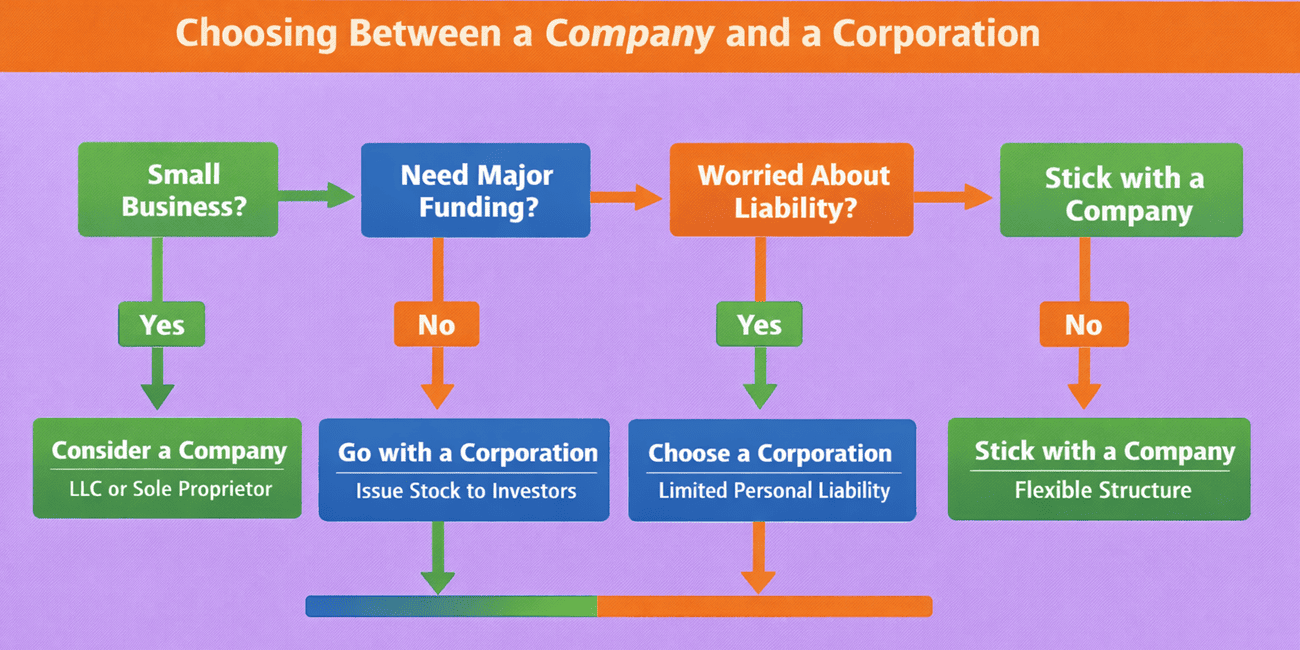

Deciding Which Structure Fits Your Needs

Choosing between remaining a company in the broad sense or forming a corporation depends on your goals, risk tolerance and growth plans.

The following are key questions to consider:

- Do you need limited liability? If your business faces risk of lawsuits or significant debt, forming an LLC or corporation can protect personal assets.

- How important is tax flexibility? Pass‑through taxation may reduce taxes for small businesses. Corporations may pay more due to double taxation unless they elect S corporation status.

- Will you seek outside investors? Corporations can sell stock to investors and employees. Many investors prefer corporate structures because they offer clearer ownership rules.

- How complex is your business? Corporations require more paperwork, formal meetings and regulatory compliance. Sole proprietors and LLCs have fewer formalities.

Advantages and Disadvantages

| Parameter | Company (sole proprietorship, partnership, LLC) | Corporation |

| Setup and cost | Easy and inexpensive to start, especially for sole proprietors and partnerships | Requires articles of incorporation, filing fees and ongoing legal compliance |

| Control | Owners have direct control; LLCs offer flexible management | Board of directors sets policies; officers manage daily operations |

| Liability | Sole proprietors and general partners have unlimited liability; LLC members enjoy limited liability | Shareholders have limited liability; personal assets are usually protected |

| Taxation | Pass‑through taxation for sole proprietors, partnerships and most LLCs | Subject to corporate tax; profits may be taxed again as dividends; S corporations avoid double taxation |

| Capital | Limited ability to raise capital; may rely on personal funds or loans | Can issue stock and attract investors; easier access to large capital |

Real‑World Examples

- A freelancer’s journey: I once coached a friend who writes marketing copy from home. She started as a sole proprietor because it let her test her services without much paperwork. As her client list expanded and she hired subcontractors, she registered an LLC to separate her business from personal assets. She remains a company owner, not a corporation, but enjoys liability protection and pass‑through taxation.

- A tech startup’s decision: When a group of engineers launched a clean‑tech startup, they needed venture capital to scale. They formed a Delaware corporation, issued stock to investors and appointed a board of directors. The corporate structure helped them secure funding and protect the founders’ personal assets.

These stories show that the right choice depends on scale, funding needs and risk appetite.

FAQs

Q1. Is an LLC a corporation?

No. An LLC is a separate legal entity that offers limited liability like a corporation but is taxed like a partnership. It is not a corporation.

Q2. Can I start as a company and become a corporation later?

Yes. Many businesses begin as sole proprietorships or LLCs and incorporate when they need investors or want stronger liability protection. The process involves filing articles of incorporation and meeting corporate formalities.

Q3. What is the main benefit of forming a corporation?

The primary benefit is limited liability; shareholders are usually not personally responsible for business debts. Corporations also have greater ability to raise capital through stock.

Q4. Do companies pay taxes differently from corporations?

Pass‑through entities like sole proprietorships and most LLCs report business income on the owners’ personal returns. Corporations pay corporate tax and may face double taxation.

Q5. Which structure is better for a small business: LLC or corporation?

LLCs offer limited liability with less paperwork and flexible taxation, making them attractive to many small businesses. Corporations may be better if you plan to issue stock or attract outside investors. Consider consulting a professional for advice.

Conclusion

Choosing between remaining a company or forming a corporation is a significant decision for any entrepreneur. Companies offer simplicity and direct control, while corporations provide strong liability protection and access to capital. The best choice depends on your risk tolerance, growth plans and resources. By understanding the differences and reviewing your goals, you can create a solid foundation for your business’s future.