Definition: The Discounted Cash Flow (DCF) analysis estimates the money an investor would receive from an investment, adjusted for the time value of money.

The time value of money shows that a dollar the business has today is worth more than a dollar they receive tomorrow.

What is Discounted Cash Flow (DCF)?

Discounted cash flow analysis finds the present value of expected future cash flows using a discount rate which is the minimum interest rate if the business puts the same money in a bank. Investors can use the concept of the present value of money to determine whether an investment or project’s future cash flows are more than the initial investment’s value.

Discounted cash flow lets economists and investors evaluate a stock, company, project, and other assets or activities.

Time Value of Money

From an economic standpoint, it’s better to receive $1 now than get the same amount in the future. Inflation and cost of living rise will crush the purchasing power of $1 if someone receives it in the future than today.

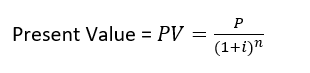

The concept of the time value of money includes the present value (PV) and future value (FV). Present Value determines how much money is worth so analysts can compare its earning/spending power today and in the future. The Future Value shows how much the money of today is worth in the future.

Mathematically,

Where

P= Future earnings

i = discount rate (cost of capital)

n = number of years

Time value of money, risk, and investment opportunities are three key factors for any business decision.

Recognizing the time value of money and risk is vital in financial decision-making. If the timing and risk of cash flows is not considered, the business can make decisions that may miss the objective of maximizing the shareholders’ wealth.

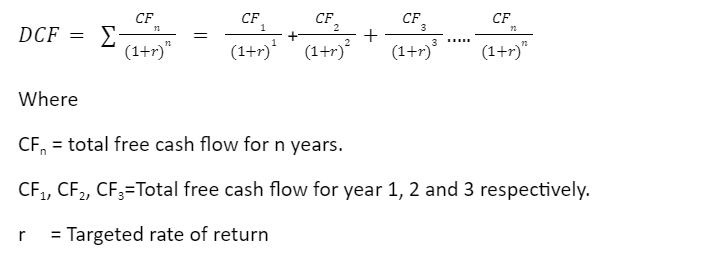

Calculating the Discounted Cash Flow

DCF analysis considers the time value of money. After forecasting the future cash flows and determining the discount rate, DCF can be calculated through the formula below:

The formula is similar to the calculation of net present value (NPV), which sums up the present value of each future cash flow.

The only difference is that the initial investment is not deducted from DCF.

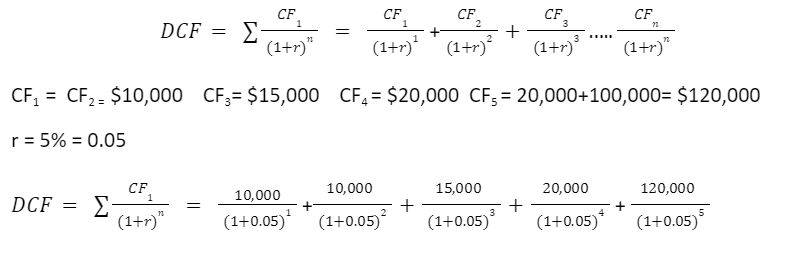

Example of Discounted Cash Flow

A company requires a $150,000 initial investment for a project that is expected to generate cash inflows for the next five years. It will generate $10,000 in the first two years, $15,000 in the third year, $20,000 in the fourth year, and $20,000 with a terminal value of $100,000 in the fifth year. Assuming the cost of capital is 5%, and no further investment is required during the term, estimate the DCF of the project.

= 9523.81+9070.29 + 12,957.56 + 16,454.05 + 98,724.3

= $146,730

Without considering the time value of money, this project will create a total cash return of $175,000, that is, by adding (CF1 to CF5) after five years, higher than the initial investment, which seems to be profitable. However, after discounting the cash flow of each period, the present value of the return is only $146,730, lower than the initial investment of $150,000.

Businesses can therefore deduce that they should not invest in the project.

Discounted Cash Flow Techniques

Some discounted cash flow techniques used in capital budgeting are:

- Net present value (NPV)

- Internal rate of return (IRR)

- Profitability Index (PI)

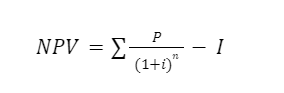

The Net Present Value method is the classic DCF technique that explicitly recognizes the time value of money.

The Internal Rate of Return (IRR) is another DCF method that considers the magnitude and timing of cash flows. In short, it is the discount rate that has the NPV = 0.

The Profitability Index (PI) measures the ratio between the present value of future cash flows and the initial investment. The index is a useful tool for ranking investment projects and showing the value created per unit of investment.

Relevance of the Discounted Cash Flow

- It can be applied to investment decisions, project selection, etc., as long as their future cash flows can be estimated.

- DCF tells the intrinsic or actual value of an investment

- It enables investors to create different scenarios to compare how their returns will change under different conditions.

- Different DCF techniques can also be used for analyzing mergers and acquisitions. They are useful in calculating an investment’s internal rate of return IRR for critical investment decisions.

- DCF is used to develop models that allow multiple scenarios to be considered for sensitivity analysis.

Limitations of Discounted Cash Flow

- It is very sensitive to estimating the cash flows, terminal value, and discount rate.

- A great deal of assumptions needs to be made to forecast future performance.

- If the future cash flows of a project cannot be reasonably estimated, its DCF is less reliable.

- It is difficult to apply this method in innovative projects and growth companies. In such cases, businesses can use other valuation models, for example, comparative analysis and precedent transactions.

- It is used to project for a longer duration. However, long-term projections may not always be accurate, considering any business or asset’s possible volatility and cyclicality.

Summary

Discount Cash Flow (DCF) analysis is a project assessment and capital budgeting method used to analyze a company’s or an asset’s present value. The technique is based on the number of cash flows the company or asset can generate in the future. It estimates the company’s future cash flow projections.

The DCF underpins the time value of money concept, which says that money in the future is not worth the same as money today. If DCF is ignored, an investor may lose the chance to invest the same money in other alternatives and earn more.

While the DCF model may be prone to errors and over complexity, investors and analysts often use it to measure the intrinsic value of an investment because it allows them to make informed financial decisions.