Kakeibo is a time-honored Japanese practice that prioritizes mindful spending and saving. Unlike traditional budgeting, Kakeibo is a financial philosophy that encourages deliberate, thoughtful money management.

Fortunately, the Kakeibo method is simple to grasp, flexible enough to accommodate any lifestyle, and completely free of charge.

What is the Kakeibo Method?

The term Kakeibo means “household financial book” in Japanese. It is a cost management journal to help users understand their connection with money and the motivations behind purchases.

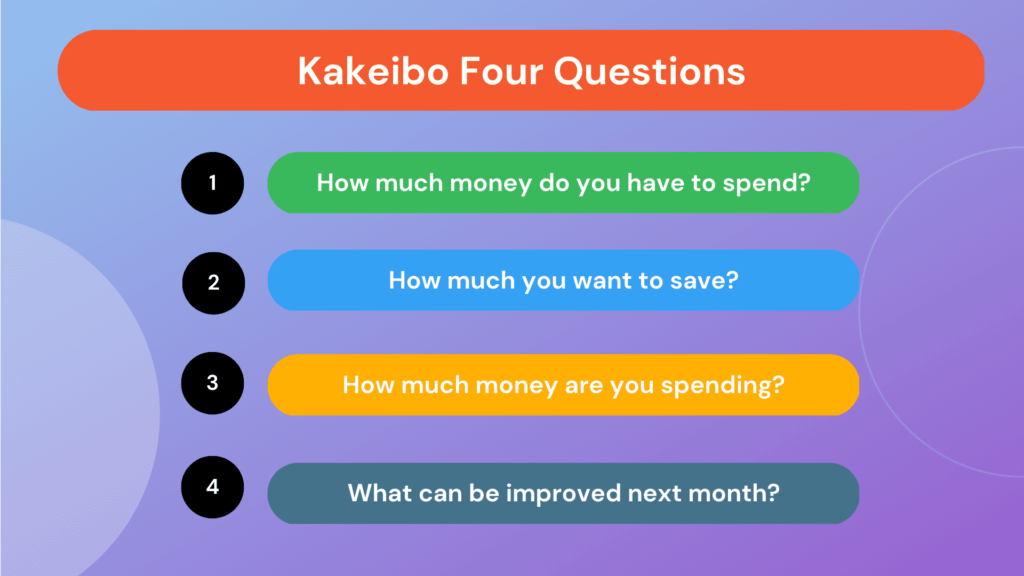

Kakeibo is centered on four issues:

- How much cash is available?

- How much is to be saved?

- How much is to be spent?

- What can be improved?

How Does Kakeibo Work?

The Kakeibo method is straightforward. At the beginning of each month, the user decides how much they want to save and what they need to attain.

The Kakeibo has four crucial questions to aid this process:

- Calculate Available Cash: Subtract fixed expenses such as rent and utilities from income to determine how much cash is available for spending and saving.

- Set Savings Target: Determine a weekly spending goal aligning with the desired target.

- Track spending: Keep a daily spending journal and record expenses by category to monitor progress towards the savings goal.

- Evaluate and Adjust: At the end of each week and month, review spending and savings to identify areas for improvement and ensure the savings objective is on track.

History of Kakeibo

Although Kakeibo is a longstanding tradition in Japan, it is a relatively new concept in the United States. In fact, the method dates back to 1904 when Japanese author Hani Motoko published an article about her savings technique in a women’s magazine, which resonated with readers.

The practice gained attention in the West in 2018 when Fumiko Chiba’s book, “Kakeibo: The Japanese Art of Saving Money,” was published. According to Chiba and other experts, Kakeibo embodies the cultural values that the Japanese place on frugality and saving money.

From an early age, Japanese children receive monetary gifts during holidays and are encouraged to save them for worthwhile purchases. Furthermore, Japan’s economy relies heavily on cash, and credit cards are not as commonly used as they are in other countries.

How To Use Kakeibo?

Using Kakeibo involves many steps that can be taken at the start of the year, at the beginning of every month, or even during the month.

It gives the user a broad overview of their finances and an in-depth examination of their expenditure.

Step 1: Conduct An Annual Review

Kakeibo journals typically include an annual planner, which serves as a starting point for tracking income and expenses over the next year. Users are encouraged to estimate their expected earnings and expenditures, taking into account recurring costs such as rent, vehicle insurance, and travel expenses.

Reviewing spending from the previous year and identifying areas where adjustments can be made helps refine the plan. Users should also consider any upcoming irregular expenses, such as bills or special occasions when setting their financial goals for the year.

Step 2: Create A Monthly Spending Plan

Before making adjustments, it is necessary to understand the current finances. To do so, answer the following questions at the beginning of the section:

- How much money is being received? List all potential sources of income for the month (salary, freelancing, etc.). Calculate the entire sum.

- How much cash will be spent? Keep track of monthly costs, including rent, utilities, health insurance, loan repayments, etc.

After obtaining these values, the monthly saving can be considered. To get this, deduct the amount to be spent from available funds.

Step 3: Calculate Weekly Expenditures

In addition to annual and monthly planning, Kakeibo also emphasizes the importance of tracking weekly expenditures. After subtracting the desired savings goal from total income, users should divide the remaining funds by the number of weeks in the month to determine their weekly spending limit.

To stay on top of weekly expenses, it is essential to record each transaction immediately and categorize them for easy tracking and identification of areas for improvement. Categories should be straightforward and intuitive to use.

Below are some categories that can be used:

- Needs: These are unavoidable costs. Some examples are rent, health insurance, food, student loans, mortgages, etc.

- Wants: These costs are flexible and can be optimized. “Wants” make people happy, e.g., coffee, takeout, etc.

- Culture: They are meant for entertainment, e.g., theaters, cinemas, Netflix, movies, etc.

- Unexpected: These are unplanned costs. Keep some money for rainy days, like automobile engine trouble or an unexpected medical cost.

Step 4: Categorize All Expenses

Once the spending categories have been established, recording all expenses and assigning them to the appropriate category is important. By doing so, users can more accurately assess their spending habits and distinguish between necessary and discretionary expenses.

Step 5: Monthly Examination

Once all incomes and costs have been documented, add them to determine if the initial spending and saving targets were met.

Step 6: Reflection

At this stage, users reflect on their budgeting method to take note of the successes and failures of their budget during the month. This process can create a new objective to reduce or eliminate improper expenses.

The Advantages of Using Kakeibo

Kakeibo offers several benefits to users seeking to improve their financial habits:

- By categorizing expenses and adhering to a spending limit, Kakeibo can help lower overall spending.

- Keeping a spending journal promotes awareness of spending patterns, which can help users reduce monthly expenses on unnecessary items.

- Kakeibo can assist in developing a savings strategy, allowing users to set aside more money for unforeseen expenses or emergencies.

- Using Kakeibo may reduce debts as users become more mindful of their spending and develop better financial habits.

Benefits of the Kakeibo Spending Plan

Kakeibo offers numerous benefits to users seeking to improve their financial management:

- By emphasizing spending limits for each category, Kakeibo teaches users to control costs.

- Regular tracking of expenses using Kakeibo increases awareness of one’s financial situation and potential savings opportunities.

- Kakeibo enables users to track both short-term and long-term revenue.

- Kakeibo encourages users to re-examine their needs and goals to live simpler life.

- Kakeibo is an excellent starting point for anyone who wants to save money, even if they have never done so before.

- Kakeibo can be used as a tool for debt relief.

- With Kakeibo’s help, users can better understand and manage their budgets.

- Kakeibo is accessible to everyone, regardless of age.

- Kakeibo is an excellent way to start learning about personal finance.

Drawbacks of the Kakeibo Method

Kakeibo recommends using two notebooks: a large one for recording income, planning expenses and savings, and a small one for tracking daily spending in real-time.

Capturing every financial transaction, no matter how small, is crucial, and the small notebook makes it easy to do so. However, manual tracking has two significant downsides.

Firstly, carrying a notebook and pen at all times may be inconvenient, especially for those who prefer to travel light.

Secondly, documenting every expense forces users to think carefully about their purchases, which may be uncomfortable.

Nevertheless, this drawback is also Kakeibo’s strength. By prompting users to reflect on their impulsive purchases and consider whether they are truly necessary, Kakeibo fosters mindful spending habits and promotes alignment with long-term financial goals.

Other Kakeibo Lessons

Kakeibo’s success lies in its mindfulness approach to personal finance. By promoting greater awareness and control over spending, Kakeibo helps users avoid the pitfalls of consumerism and gain a broader perspective on their financial goals.

Rather than relying on digital tools, Kakeibo encourages users to record their expenses by hand, making spending a tangible and personal experience. By incorporating Kakeibo’s lessons into daily life, users can cultivate a greater sense of cost-consciousness and learn valuable skills for managing their finances.

- Postpone any unnecessary purchases until the next month. After a month, if there is still the urge to buy, consider whether it is affordable and its value.

- When shopping for monthly needs, make a list. There would be a lesser urge to make impulsive purchases when there is a list of needed things.

- If anything is on sale, consider if there would be an urge to buy it even if it wasn’t for sale.

- Attempt to pay with cash wherever possible. This makes accounting easier, which is harder with credit cards mentally.

Conclusion

The Kakeibo technique is a powerful tool for anyone looking to take control of their finances. Emphasizing the importance of every expense helps individuals develop a deep understanding of their spending habits and the true cost of reaching their savings goals.

Through careful budgeting and a Yoda-like approach to shopping, Kakeibo enables individuals to closely monitor their finances and make informed decisions about allocating their resources. And for those who enjoy journaling, Kakeibo offers a fun and engaging way to learn about personal finance.