Businesses have to make decisions; they pick between several options since they do not have enough resources to pursue all chances.

When a company decides to pursue option A rather than option B, the value of option B represents the opportunity cost of picking option A. Calculating opportunity cost enables organizations to make educated decisions and more advantageous economic choices regarding the allocation of limited resources to minimize risk and maximize returns.

When making a decision, it is necessary to consider both the implicit and explicit costs.

For instance, if a manager decides not to hire two additional employees to satisfy their consumers’ demand, they will be responsible for the opportunity cost of missing deadlines and having unhappy clients. Although management may believe they have reduced costs by not adding new personnel.

Explicit costs are those that are directly borne by the company in the process of acquiring goods and services. Examples of explicit expenses include salaries, purchasing raw materials, gasoline, transportation, etc.

On the other hand, implicit costs are the indirect expenses that comprise the business owner’s resources and services, such as an office building, energy, and other things.

According to Economics icon Milton Friedman, there is a price you’re paying for whatever you think is free. He says nothing is free in a world of scarce resources. “No free lunch, not even in Freetown.”

What is the Opportunity Cost?

Definition: Opportunity cost can be defined as the value a business gives up to choose another choice. This concept is based on the theory of alternative costs, which portends the cost of one choice regarding the opportunity foregone in the next best choice.

The next best alternative that could be created instead of the same factors or by an equivalent combination of factors at the same price is what economists mean when they refer to something as having an opportunity cost.

They believe that economic profit is contingent upon making a profit after deducting the alternative cost of capital, as opposed to the popular accountant’s profit, in which businesses merely consider the total cost of operations. They believe this to be true in contrast to the popular accountant’s profit (explicit).

This demonstrates that economic profit is almost always lower than the profit reported by an accountant.

Opportunity cost is the highest value a business needs to give up for the selected choice. It is the loss of potential return from the second-best unselected project. In other words, it is the opportunity that will not be realized when one project is selected over another.

Formula to Calculate Opportunity Cost

Mathematically,

Opportunity Cost = [Return on Next-Best Option Not Chosen] – [Return on the Chosen Option]

Opportunity cost is the difference between the anticipated return of both choices.

Examples of Opportunity Cost

Let’s say a student did not visit a leisure party but instead decided to study.

The opportunity cost is the enjoyment he could have at the party.

Instead of coffee, a couple purchased a cold drink. The opportunity cost is the cost of the coffee.

An organization has project A worth 100,000 USD and other project B worth 80,000 USD. They select project A to proceed. The opportunity cost is 80,000 USD.

Opportunity Cost Vs. Sunk Cost

The cost of anything that has already been spent and cannot be recouped is referred to as a “sunk cost.” They are irrelevant to the decision-making process since they represent costs already incurred. Companies have a responsibility to identify these expenses and distinguish them from the future costs that will be taken into consideration during the decision-making process.

The amount of money that has already been spent ought to have no influence on the decisions that will be made in the future.

In this scenario, spent expenses are not considered until there are particular variable outcomes. The sunk cost fallacy, in which managers are tempted to pursue a course of action because of the funds that have already been committed to it, despite the fact that it delivers no benefit, can be circumvented with this assistance.

If a firm follows a specific course of action for its business without first weighing the benefits of alternative courses of action, it runs the risk of failing to recognize the opportunity costs that could have been avoided if the company had taken a different course of action.

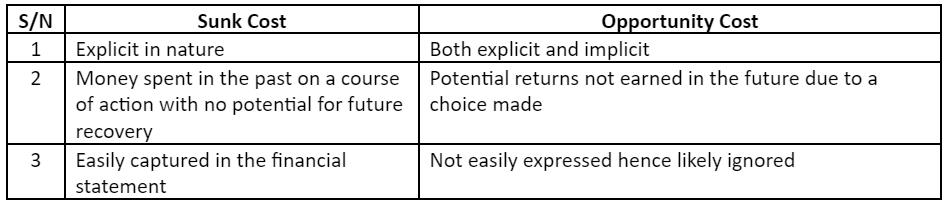

The differences between sunk cost and opportunity cost are compared and contrasted in the table below.

Opportunity Cost Vs. Risks

In economics, the term “risk” refers to the chance that the actual returns on investment may differ from those expected. There is a possibility that the investor will suffer a loss of some or all of their money. The term “opportunity cost” refers to the risk that the returns on an investment strategy will be lower than the returns on an alternative investment strategy.

The most important distinction is that risk evaluates the actual performance of an investment in relation to its expected performance, whereas return evaluates only the projected performance of an investment.

On the other hand, the concept of opportunity cost contrasts the actual performance of one investment with the actual performance of another.

Importance of Opportunity Cost

In project management, organizations must understand opportunity cost as it helps select one project over another. This theory explains how choices are made regarding allocating scarce resources. For example, when assessing the potential profitability of various investments, managers look for the option that is likely to yield the greatest return.

Opportunity cost helps managers to fix the price of a factor. For instance, assume that the alternative employment of a university professor is to work as a consultant in an investment company at a salary of 3,000 USD per month. In such a case, he has to be paid at least 3,000 USD to continue to work at the university.

Managing Opportunity Cost

Businesses can change their costs or minimize their overall future effort by considering opportunity costs. The visualization provided by opportunity costs facilitates the ability to examine and successfully manage both implicit and explicit costs and increase transparency and decision-making.

If a company has access to project funds, it needs to choose the endeavor that will yield the greatest profit. The fact that intended profits are obtained in the future makes them susceptible to risk. Before being factored into the calculation, they are modified to account for the risks involved.

After considering the potential risks involved, the opportunity cost is the difference in returns that can be earned between one project opportunity and the next most favorable opportunity that competes for the same money. The function of the project manager in this scenario is to give risk input to optimize the returns to the greatest extent possible and to manage capital budgets to reduce the amount of money spent on capital.

These two pursuits will result in the highest possible profits while simultaneously lowering the opportunity cost of the enterprise.

Challenges with Opportunity cost

One major challenge of opportunity cost is accurately determining implicit costs, which involves many variables.

Conclusion

While many economists consider opportunity cost to be a real cost, it typically does not get reported directly on a company’s financial statements because it is considered an abstract cost. When analyzing opportunity costs, it is impossible to predict how various factors will affect the outcome.

The opportunity cost is something that should be taken into consideration, though, as it is the expense that is not immediately obvious that is connected with choosing one path of action over another. As a result, not only does it assist in resolving economic issues, but it also assists in optimizing value.