Definition: A partnership is a relationship between two or more people doing business. Each person contributes funding, experience, knowledge, and labor. They share the profit and loss in the business according to their contribution.

A business can have many forms of structure, such as sole proprietorship, partnership, limited liability, joint venture, non-profit organization, public corporation, and cooperative society.

A partnership is born when two or more individuals form and own a business, and the parties are called partners. It is common at a small scale; at the corporate level, it is called mergers, joint ventures, or strategic alliances.

Partners get income and pay taxes individually. However, the government does not tax the business separately, as corporations are on profits or losses.

The partnership agreement reduces uncertainty when the partners make decisions or resolve a dispute.

The Nature of Partnerships

A partnership is a form of business where two or more people share ownership and management of the firm and the income or losses. A partnership can start without a written contract. However, partners can have formal written contracts known as partnership deeds or agreements.

Every country has laws guiding business partnerships. For example, The Uniform Partnership Act (UPA) governs business partnerships in several U.S. states.

A partnership is like a joint venture. However, a partnership involves individuals, while a joint venture involves companies.

A partnership, like a sole proprietorship, is legally and financially inseparable from its owners. Creating partnerships is easier and less costly than creating corporations.

The steps of forming partnerships include:

- Choose a structure based on collective vision and goals.

- Draft a partnership agreement.

- Name the business.

- Register the partnership name.

- Prepare and submit annual reports.

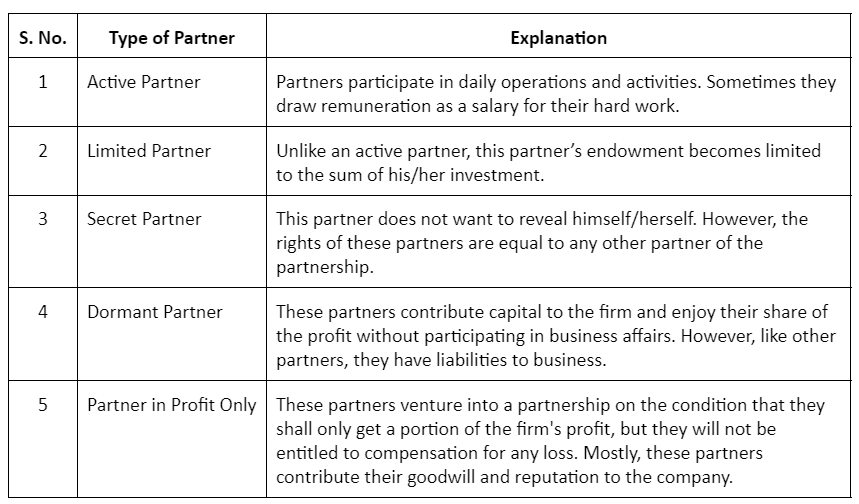

Types of Partners

Types of Partnerships

A business can have four types of partnerships:

#1. General Partnership

A General Partnership (GP) is the most basic form of partnership. It does not require forming a business entity with the state. In most cases, partners sign a partnership agreement to form the business.

They split the ownership and profits based on their investment or as per the condition agreed in the agreement.

Each partner is liable for business, meaning they are responsible for business debts and legal obligations.

#2. Limited Partnership (LP)

This is a formal business entity with state approval. They have at least one partner fully responsible for the business and one or more limited partners who can provide the funding but may not involve with the business actively.

Limited partners invest in the business for financial returns and are not responsible for the firm’s debts and liabilities; they share the profit for their investment. Therefore, they cannot lose more than the investment.

In some US states, limited partners may not qualify for pass-through taxation.

#3. Limited Liability Partnership (LLP)

This partnership is like a general partnership, with all partners actively managing the business, but it limits their liability for one another’s actions. The partners still bear responsibility for the debts and legal liabilities of the business, but they are not responsible for the errors and omissions of their fellow partners.

LLPs are not permitted in all states and are often limited to certain professions, such as doctors, lawyers, and accountants.

#4. Limited Liability Limited Partnership (LLLP)

This is a newer type of partnership available in some states. It operates like a limited partnership, with at least one general partner who manages the business, but the LLLP limits the general partner’s liability, so all partners have liability protection.

Taxes in Partnership

In the USA, a partnership must file information on income, profit, loss, and deduction annually from its operations. However, it does not pay income taxes. Instead, the taxes pass to the partners.

Each partner must report taxes along with their income tax.

Pros of Partnerships

A partnership has many advantages for business, a few of them are as follows:

- Ease of Starting and Dissolution: Businesses can set partnerships easily and quickly as it requires a few legal formalities and small expenditures. They can dissolve it easily after receiving consent from all partners and the terms and conditions mentioned in the contract.

- Higher Capital: Many partners contribute capital, so working capital is available for greater productivity and profitability. Finance is a key motivator for partnership.

- Greater Innovation Drive: Partners bring ideas that foster managerial and entrepreneurial acumen.

- Productivity: Specialization is seen in partnership as partners focus on their core competencies for the firm to earn more profit. For example, a specialist in Obstetrician and Gynecology may partner with one in Pediatrics, enlarging the sphere of customer base.

Cons of Partnership

- Secrecy Issues: Business secrets can become leaked to competitors due to the carelessness of a partner or a conflict among the partners.

- Uncertain Existence: The death of any partner can cause the death of the business, especially if there is no proper legal framework for continuity. Besides, dishonesty, conflict, and lack of resources can also collapse the firm.

- Poor Access to Customers: Unlike the case of a sole proprietor, a partner cannot maintain close contact with customers and employees, especially for a limited partner.

- Unlimited Liability: The partners may be liable for all the debts of the business based on their contribution. If the assets are insufficient to meet the debts, their personal property can become liquidated.

Conclusion

When like-minded people share a common goal, they can channel their knowledge and experiences to form a partnership. Business partnerships help address fundamental issues, such as ownership and the roles and responsibilities of each partner. However, it is equally important to have a well-crafted partnership agreement to protect the partners against personal liability.