This blog post will provide all PMP Formula Calculations.

In the PMP certification exam, you will see formula-based questions requiring mathematical calculations. Although there is no fixed number of questions from this area, a general assumption is that you may see around 10-20% formula-based questions on your PMP exam.

Compared to other questions, formula-based questions are easy to solve with a little practice if you understand the concepts.

In the PMBOK Guide, you will find many formulas without explanation or examples.

So, in this blog post, I will explain all the formulas in the PMBOK Guide with a simple example. After reading this blog post, I hope you will have a solid understanding of all PMP formulas.

PMP Formula Calculation

All these formulas are distributed across four knowledge areas of the PMBOK Guide. These knowledge areas are:

- Cost Management

- Risk Management

- Procurement Management

- Schedule Management

The cost management knowledge area involves most formulas, so we will start with it.

Cost Management

Clients are only interested in two kinds of information about your project:

- Whether you are on budget

- Whether you are on schedule

You will have to provide this information to your client regularly. As long as you are on track, no action is needed; however, if there is a deviation from the baselines, you must take corrective action.

This information can be a status report, progress report, performance report, etc.

Two parameters were used to check the project’s performance in the early days. These parameters were:

- Planned Expenditure

- Actual Expenditure

The information given by these parameters was incomplete as it says nothing about the completed work, and there was no way to relate the completed work to expenditures.

To overcome these flaws, the US Air Force developed a new concept, “Earned Value Management,” which helped fill the gap.

This concept elaborated on the “value of completed work.”

Now the project managers can measure the performance of the project.

The concept of earned value management is discussed in the PMBOK Guide.

As per the PMBOK Guide,

“Earned Value Management (EVM) in its various forms is a commonly used method of performance measurements. It integrates project scope, cost, and schedule measures to help the project management team assess and measure the project performance and progress.”

Earned value management has three basic elements:

- Planned Value

- Earned Value

- Actual Cost

Planned Value: This is the scheduled cost planned for work in a given time. Planned Value is also known as Budgeted Cost of Work Scheduled (BCWS).

Put more simply, this is the value that you should earn as per the schedule for a given duration.

You can calculate the planned value by using the following formula:

Planned Value = (Planned% Complete) X (BAC)

Here BAC is Budget at Completion.

Example

You are working on a project scheduled to be completed in two years. The Budget at Completion of the project is 200,000 USD. After one year, when you review the schedule, it says that 55% of the project should have been completed by now.

Calculate the planned value.

Given in this question:

Project duration: 24 months

Project cost (BAC): 200,000 USD

Time elapsed: 12 months

Percent complete: 55% (as per the schedule)

We know that the planned value is the value of the work that should have been completed as per the schedule.

In this case, we should have completed 55% of the total work.

Planned Value = 55% of the value of the total work

= 55% of BAC

= 55% of 200,000

= (55/100) X 200,000

= 110,000 USD

Therefore, the planned value is 110,000 USD.

Earned Value: This is the value earned from the completed work at a given time. Earned Value is also known as Budgeted Cost of Work Performed (BCWP).

Put simply, with the earned value, you know how much value you have earned from the money you have spent to date.

Earned value plays a significant role because if the project is terminated today, the earned value shows you the value that the project has produced.

The formula to calculate earned value is:

Earned Value = % of completed work X BAC

Example

You are working on a project scheduled to be completed in two years. The Budget at Completion of the project is 200,000 USD. After one year, when you review the progress, you find that 50% is completed, although the schedule says that 55% of the project should have been completed by now.

Calculate the Earned Value.

In the above question, you can see that only 50% of the work is actually completed, and the definition of Earned Value states that it is the value of the project that has been earned.

Earned Value = 50% of the value of total work

= 50% of BAC

= 50% of 200,000

= 0.5 X 200,000

= 100,000 USD

Therefore, the earned value is 100,000 USD.

Actual Cost: This is the actual amount of money spent to date. Actual Cost is also known as Actual Cost of Work Performed (ACWP).

Simply put, it is the amount of money you have spent on the project to date.

The formula to calculate the actual cost is as follows:

Actual cost = Amount spent to date

Finding the Actual Cost is the easiest of all.

Example

You are working on a project scheduled to be completed in two years. The Budget at Completion of the project is 200,000 USD. After one year, you have spent 105,000 USD. When you review the progress, you find that 50% is completed, although the schedule says that 55% of the project should have been completed by now.

Calculate the actual cost.

The Actual Cost is the amount of money that you have spent so far.

In the question, you have spent 105,000 USD on the project so far.

Hence,

The actual cost is 105,000 USD.

With this information on hand, you can calculate the following variances and performance indices:

- Schedule Variance

- Cost Variance

- Schedule Performance Index

- Cost Performance Index

Schedule Variance

The schedule variance is the difference between earned and planned values. It helps you determine if you are ahead or behind schedule in dollar terms.

The formula to calculate schedule variance is:

Schedule Variance = Earned Value – Planned Value

SV = EV – PV

You can say that:

- If schedule variance is negative, you are behind schedule.

- If schedule variance is positive, you are ahead of schedule.

- If schedule variance is zero, you are on schedule.

Please note that at the end of the project, the schedule variance becomes zero because once the project is complete, all planned value has been earned.

Example

You are working on a project scheduled to be completed in two years. The Budget at Completion of the project is 200,000 USD. After one year, you have spent 105,000 USD. When you review the progress, you find that 50% is completed, although the schedule says that 55% of the project should have been completed by now.

Calculate the schedule variance and determine if you are ahead or behind schedule.

Given in the question:

Actual Cost (AC) = 105,000 USD

Planned Value (PV) = 55% of 200,000

= 110,000 USD

Earned Value (EV) = 50% of 200,000

= 100,000 USD

Now,

Schedule Variance = Earned Value – Planned Value

= 100,000 – 110,000

= – 10,000 USD

The schedule variance is –10,000 USD. Since it is negative, you are behind schedule.

Cost Variance

Cost variance is the difference between earned value and the actual cost. It helps you determine if you are under budget or over budget in dollar terms.

The formula to calculate cost variance is:

Cost Variance = Earned Value – Actual Cost

You can say that:

- If cost variance is negative, you are over budget.

- If cost variance is positive, you are under budget.

- If cost variance is zero, you are on budget.

Example

You are working on a project scheduled to be completed in two years. The Budget at Completion of the project is 200,000 USD. One year has passed, and you have spent 105,000 USD. When you review the progress, you find that 50% is completed, although the schedule says that 55% of the project should have been completed by now.

Find the cost variance and determine if you are under budget or over budget.

Given in the question:

Actual Cost = 105,000 USD

Earned Value = 50% of 200,000 USD

= 100,000 USD

Now,

Cost Variance = Earned Value – Actual Cost

CV = EV – AC

= 100,000 – 105,000

= –5,000 USD

Hence, the cost variance is -5,000 USD, and since it is negative, you are over budget.

Schedule Performance Index

Schedule Performance Index and Cost Performance Index, like variances, allow you to assess the health of a project. They help you analyze the efficiency of performance.

As per the PMBOK Guide, “The Schedule Performance Index (SPI) is a measure of schedule efficiency, expressed as the ratio of earned value to planned value.”

It is the efficiency of the time used on the project. It gives you information on how efficiently you are progressing compared to the planned project schedule.

The Schedule Performance Index can be determined by dividing earned value by planned value.

The formula to calculate the schedule performance index is:

Schedule Performance Index = (Earned Value) / (Planned Value)

SPI = EV / PV

You can conclude that:

- If the SPI is greater than one, you are ahead of schedule.

- If the SPI is less than one, you are behind schedule.

- If the SPI is equal to one, you are on time.

Example

You are working on a project scheduled to be completed in two years. The Budget at Completion of the project is 200,000 USD. After one year, you have spent 105,000 USD. When you review the progress, you find that 50% is completed, although the schedule says that 55% of the project should have been completed by now.

Calculate the schedule performance index and determine if you are ahead or behind schedule.

Given in the question:

Actual Cost (AC) = 105,000 USD

Planned Value (PV) = 55% of 200,000

= 110,000 USD

Earned Value (EV) = 50% of 200,000

= 100,000 USD

Now,

Schedule Performance Index = Earned Value / Planned Value

= 100,000 / 110,000

= 0.91

The schedule performance index is 0.91. As it is less than one, you are behind schedule.

Cost Performance Index

The Cost Performance Index tells you how much you are earning for each dollar spent on the project. It gives you the cost efficiency of the project.

As per the PMBOK Guide, “The Cost Performance Index (CPI) is a measure of the cost efficiency of budgeted resources, expressed as a ratio of earned value to actual cost.”

The formula to calculate the cost performance index is given below.

The cost performance index can be determined by dividing the earned value by actual cost.

Cost Performance Index = (Earned Value) / (Actual Cost)

CPI = EV / AC

You can say that:

- If the CPI is greater than one, you are under budget.

- If the CPI is less than one, you’re over budget.

- If the CPI is equal to one, you are on budget

Example

You are working on a project scheduled to be completed in two years. The Budget at Completion of the project is 200,000 USD. One year has passed, and you have spent 105,000 USD. When you review the progress, you find that 50% is completed, although the schedule says that 55% of the project should have been completed by now.

Find the cost performance index and determine if you are under budget or over budget.

Given in the question:

Actual Cost = 105,000 USD

Earned Value = 50% of 200,000 USD

= 100,000 USD

Now,

Cost Performance Index = Earned Value / Actual Cost

CV = EV / AC

= 100,000 / 105,000

= 0.95

The cost performance index is 0.95, and as it is less than one, you are over budget.

With earned value information on hand, you can proceed to forecast.

Forecasting helps you predict future performance with the help of past performance information. These forecasting tools help you find future deviations so you can take corrective action to avoid them.

We use three techniques in project management for forecasting:

- Estimate at Completion

- Estimate to Complete

- To Complete Performance Index

Estimate at Completion

The Estimate at Completion provides you with the forecasted value of the project when it is completed.

The Estimate at Completion can be determined by three methods depending on the situation; however, from a PMP certification exam point of view, the first method is the most important.

Case 1:

In this case, you assume that the future performance will be the same as past performance; i.e. the CPI will remain the same for the rest of the project.

Here the formula will be:

Estimate at Completion = (Budget at Completion) / (Cost Performance Index)

Or,

EAC = BAC / CPI

You can say that if the CPI = 1, then EAC = BAC. This means you can complete your project with your approved budget and forecasting analysis is not required here.

Example

You are working on a project scheduled to be completed in two years, and the BAC of the project is 200,000 USD. One year has passed, and 120,000 USD has been spent, but on closer review, you find that only 40% of the work has been completed so far; however, as per the schedule you should have completed 50%.

Calculate the Estimate at Completion of the project.

Given in the question:

Budget at Completion (BAC) = 200,000 USD

Actual Cost (AC) = 120,000 USD

Planned Value (PV) = 50% of 200,000

= 100,000 USD

Earned Value (EV) = 40% of 200,000

= 80,000 USD

To calculate the EAC, first, you will calculate the Cost Performance Index:

Cost Performance Index (CPI) = EV / AC

= 80,000 / 120,000

= 0.67

Cost Performance Index (CPI) = 0.67

Now,

Estimate at Completion (EAC) = BAC / CPI

= 200,000 / 0.67

= 298,507

Hence, the Estimate at Completion is 298,507 USD.

This means if the project continues to progress with CPI = 0.67 until the end, you will have to spend 298,507 USD to complete the project.

Case 2

In this case, you have deviated from your cost baseline; however, from now on, you can complete the remaining work as planned.

This usually happens when, due to some unforeseen or one-time conditions, costs have increased.

To calculate the EAC, you will add the money spent to date to the budgeted cost for the remaining work.

Estimate at Completion = Money spent to date + Budgeted cost for the remaining work

EAC = AC + (BAC – EV)

Example

You are working on a project whose BAC is 1,000,000 USD. During the execution, an incident occurs, which costs you a lot of money. This was a one-time event and will not occur again, and you can continue with your calculated performance for the rest of the project.

To date, you have spent 400,000 USD, and the value of the completed work is 350,000 USD.

Calculate the Estimate at Completion (EAC).

Since the cost increase is a one-time event and the rest of the work can be completed as planned, you will use the formula:

Estimate at Completion = Money spent to date + (Budgeted cost for the remaining work – Earned Value)

EAC = AC + (BAC – EV)

Given in the question:

Actual Cost (AC) =400,000 USD

Budget at Completion (BAC) = 1,000,000

Earned Value (EV) = 350,000

Hence,

EAC = 400,000 + (1,000,000 – 350,000)

= 400,000 + 650,000

= 1,050,000 USD

Hence, the Estimate at Completion is 1,050,000 USD.

Case 3

In this case, you are behind schedule and over budget, but the client is asking you to complete the project on time.

Here both the cost and the schedule need to be taken into consideration.

The formula to calculate the EAC will be:

Estimate at Completion = Money spent to date + (Budgeted cost for the remaining work – Earned Value) / (Cost Performance Index * Schedule Performance Index)

EAC = AC + (BAC – EV) / (CPI * SPI)

Example

You have a project with a BAC of 500,000 USD. So far, you have spent 200,000 USD, and the value of the completed work is 175,000 USD. However, as per the schedule, you should have earned 225,000 USD to date.

Calculate the Estimate at Completion (EAC).

Given in the question:

Budget at Completion (BAC) =500,000 USD

Actual Cost (AC) = 200,000 USD

Earned Value (EV) = 175,000 USD

Planned Value (PV) = 225,000 USD

To calculate the EAC, first, you will calculate the CPI and SPI:

SPI = EV / PV

= 175,000 / 225,000

= 0.78

CPI = EV / AC

= 175,000 / 200,000

= 0.88

Now, you can calculate the EAC.

EAC = AC + (BAC – EV) / (CPI * SPI)

= 200,000 + (500,000 – 175,000) / (0.88 * 0.78)

= 200,000 + 325,000 / 0.69

= 200,000 + 471,000

= 671,000 USD

Hence, the Estimate at Completion is 671,000 USD.

Estimate to Complete

Estimate to Complete is the amount of money required to complete the remaining work.

Calculating the Estimate to Complete is straightforward.

First, you will find the estimate at completion, then subtract the actual cost spent from it.

Estimate to Complete = Estimate at Completion – Actual Cost

ETC = EAC – AC

Example

You are working on a project scheduled to be completed in two years, and the BAC of the project is 200,000 USD. One year has passed, and 120,000 USD has been spent, but on closer review, you find that only 40% of the work has been completed so far, though as per the schedule you should have completed 50%.

Calculate the Estimate to Complete.

Given in the question:

Budget at Completion (BAC) = 200,000 USD

Actual Cost (AC) = 120,000 USD

Planned Value (PV) = 50% of 200,000

= 100,000 USD

Earned Value (EV) = 40% of 200,000

= 80,000 USD

To calculate the EAC, first, you have to calculate the Cost Performance Index:

Cost Performance Index (CPI) = EV / AC

= 80,000 / 120,000

= 0.67

Cost Performance Index (CPI) = 0.67

Now,

Estimate at Completion (EAC) = BAC / CPI

= 200,000 / 0.67

= 298,507 USD

Estimate at Completion (EAC) is 298,507 USD.

We know that:

ETC = EAC – AC

= 298,507 – 120,000

= 178,507 USD

In other words, if the project continues to progress with CPI = 0.67 until the end, you will have to spend 178,507 USD to complete the remaining work.

Variance at Completion

Variance at Completion is the difference between the Budget at Completion and Estimate at Completion. It tells you how much you are under budget or over budget when the project is finished.

Variance at Completion = Budget at Completion – Estimate at Completion

VAC = BAC – EAC

Example

You are working on a project scheduled to be completed in two years, and the BAC of the project is 200,000 USD. One year has passed, and 120,000 USD has been spent, but on closer review, you find that only 40% of the work has been completed so far, though as per the schedule you should have completed 50%.

Calculate the Variance at Completion of the project.

Given in the question:

Budget at Completion (BAC) = 200,000 USD

Actual Cost (AC) = 120,000 USD

Planned Value (PV) = 50% of 200,000

= 100,000 USD

Earned Value (EV) = 40% of 200,000

= 80,000 USD

To calculate the EAC, first, you have to calculate the Cost Performance Index:

Cost Performance Index (CPI) = EV / AC

= 80,000 / 120,000

= 0.67

Therefore, the Cost Performance Index is 0.67

Now,

Estimate at Completion (EAC) = BAC / CPI

= 200,000 / 0.67

= 298,507 USD

Estimate at Completion (EAC) is 298,507 USD.

We know that:

VAC = BAC – EAC

= 200,000 – 298,507

= 98,507 USD

Hence the Variance at Completion of the project is 98,507 USD.

To Complete Performance Index

The TCPI is your future cost performance index that you need to maintain to complete the project within the given budget. It is denoted by TCPI.

As per the PMBOK Guide:

“TCPI is the calculated cost performance index that is achieved on the remaining work to meet the specified management goal, such as the BAC or the EAC.”

The TCPI can be calculated by dividing the remaining work by the remaining funds:

TCPI = (Remaining Work) / (Remaining Funds)

You can find the remaining work by subtracting the earned value from the total budget; i.e. BAC – EV.

However, you have two situations to find the remaining funds. In the first case, you are under budget, and in the second case, you are over budget.

When you are under budget, the TCPI formula will be:

TCPI = (BAC – EV) / (BAC – AC)

When you are over budget, the TCPI formula will be:

TCPI = (BAC – EV) / (EAC – AC)

Now we will discuss numerical problems for each case.

Example-I

You are working on a project whose BAC is 400,000 USD and is scheduled to be completed in 48 months. Two years have passed, 220,000 USD has been spent, and 60% of the work has been completed so far, though as per the schedule you should have completed 50%.

Find the To Complete Performance Index (TCPI) for this project.

Given in the question:

Budget at Completion (BAC) = 400,000 USD

Actual Cost (AC) = 220,000 USD

Planned Value (PV) = 50% of 400,000

= 200,000 USD

Earned Value (EV) = 60% of 400,000

= 240,000 USD

Cost Performance Index (CPI) = EV / AC

= 240,000 / 220,000

= 1.1

Since the cost performance index is greater than one, you are under budget. Therefore, in this case, you will use the TCPI formula based on the BAC.

Hence,

TCPI = (BAC – EV) / (BAC – AC)

= (400,000 – 240,000) / (400,000 – 220,000)

= 160,000 / 180,000

= 0.89

This means that you can continue with a Cost Performance Index of 0.89 to complete the project.

Example-II

You are working on a project whose budget at completion is 200,000 USD and is scheduled to be completed in two years. One year has passed, and 120,000 USD has been spent, but on closer examination, you find that only 40% of the work has been completed so far, though as per the schedule 50% of the work should be completed.

Calculate the To Complete Performance Index:

Given in the question:

Budget at Completion (BAC) = 200,000 USD

Actual Cost (AC) = 120,000 USD

Planned Value (PV) = 50% of 200,000

= 100,000 USD

Earned Value (EV) = 40% of 200,000

= 80,000 USD

Cost Performance Index (CPI) = EV / AC

= 80,000 / 120,000

= 0.67

Hence, the Cost Performance Index (CPI) = 0.67

Since the cost performance index is less than one, you are over budget.

Now you will calculate the new estimate at completion and use the formula based on the EAC.

Estimate at Completion (EAC) = BAC / CPI

= 200,000 / 0.67

= 298,506 USD

Hence, Estimate at Completion (EAC) = 298,506 USD

Now, TCPI = (BAC – EV) / (EAC – AC)

= (200,000 – 80,000) / (298,506 – 120,000)

=120,000 / 178,506

=0.67

TCPI = 0.67

This means that you can continue with a Cost Performance Index of 0.67 to complete the project.

Risk Management

You will see two types of questions in the risk management knowledge area. The first is based on expected monetary value, and the other is a decision tree method.

Expected Monetary Value

Expected monetary value (EMV) is used to quantify the risks and then find the contingency reserve.

EMV = Probability X Impact

The EMV of an event is equal to the probability of the event happening multiplied by the impact.

EMV can be either positive or negative. A positive EMV means you will benefit, and a negative EMV means a loss for you.

If you have multiple risk events, the EMV of these events will be equal to the algebraic sum of the EMV of all events.

Example:

In your project, you have identified a risk event, and if it occurs, it will cause you a loss of 5,000 USD. The chance of this risk happening is 30%. What is the Expected Monetary Value of this risk event?

Expected Monetary Value (EMV) = Probability * Impact

= 0.3 * (-5,000)

= -1,500 USD

Hence, the Expected Monetary Value of this risk event is -1,500 USD.

Example:

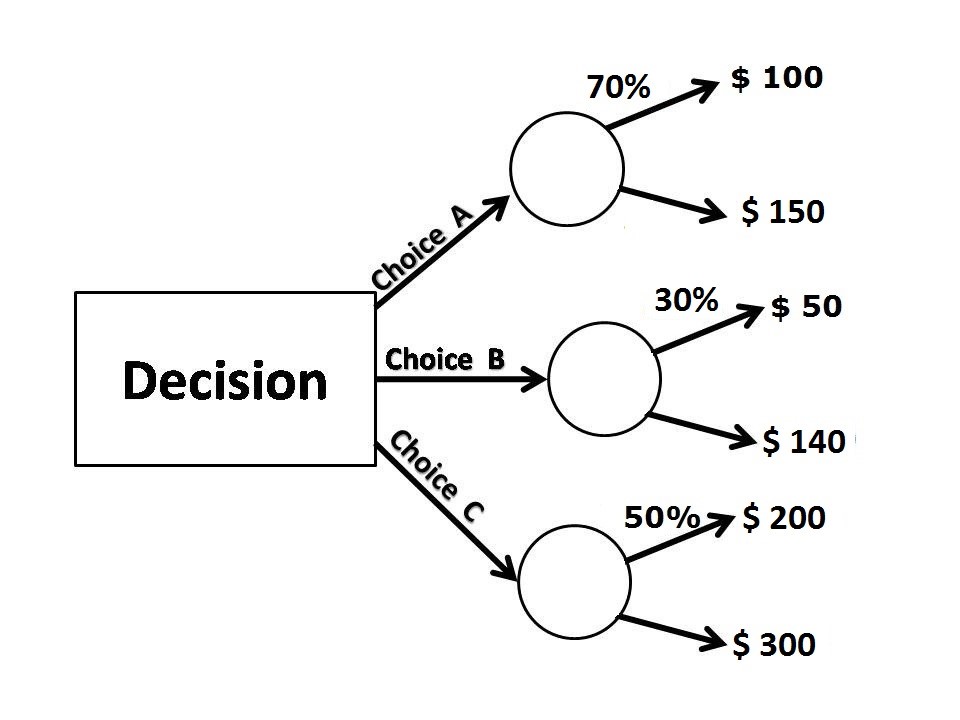

Based on the below decision tree, find the EMV of choice A, and determine which choice is better than the rest.

For Choice A, there is a 70% chance of spending 100 and 30% (100 – 70) chance of spending 150.

Hence, the EMV of Choice A = 70% of 100 + 30% of 150.

= 0.7*100 +0.3*150

= 70 + 45

= 115

Hence, the EMV of Choice A is 115 USD.

Now to decide on the best option, we will calculate the EMV of other choices and select the option with the highest EMV because all risks are opportunities.

Since we have calculated the EMV of A, we will now calculate B and C.

EMV of Choice B = 30% of 50 + 70% of 140

= 0.3*50 + 0.7*140

= 15 + 98

= 113

Hence, the EMV of Choice B is 113.

EMV of Choice C = 50% of 200 + 50% of 300

= 0.5*200 + 0.5*300

= 100 + 150

= 250

Hence, the EMV of Choice C is 250.

All EMVs are positive, and since the EMV of Choice C is the highest, it is the best option to go with.

Procurement Management

In procurement management, the concept of Point of Total Assumption is mentioned in the sixth edition of the PMBOK Guide.

The Point of Total Assumption is the point above which the cost is borne by the seller.

If the seller crosses the ceiling price, it is assumed that this cost has been overrun due to mismanagement by the seller, and it is their responsibility to bear this cost overrun.

Here is the formula to calculate the Point of Total Assumption:

Point of Total Assumption (PTA) = [(Ceiling Price – Target Price)/Buyer’s Share Ratio] + Target Cost

Example:

With the following information on hand, calculate the Point of Total Assumption.

Target Cost = 200,000 USD

Target Profit = 20,000 USD

Target Price = 230,000 USD

Ceiling Price = 240,000 USD

Share Ratio = 80% buyer, and 20% seller

Point of Total Assumption (PTA) = [(Ceiling Price – Target Price)/Buyer’s Share Ratio] + Target Cost

Point of Total Assumption = (240,000 – 230,000)/0.8 + 200,000

= 10,000/0.8 + 200,000

= 12,500 + 200,000

= 212,500

Hence, the Point of Total Assumption is 212,500 USD.

Schedule Management

In this knowledge area, you will see three types of mathematical questions:

- Triangular or Beta Distribution

- Critical Path Calculations

- Finding Total and Free Float

Triangular and Beta Distribution

Triangular and beta distributions are used to calculate the activity duration. To calculate these estimates, you use three estimates for each activity:

- Optimistic Estimate

- Pessimistic Estimate

- Most Likely Estimate

The optimistic estimate is the least possible time in which the activity can be finished. It is denoted by to.

The pessimistic estimate is the worst-case scenario. It is denoted by tp.

The most likely estimate is the most probable time the activity will take to be completed. It is denoted by tm.

Once you get these three estimates, you can calculate the triangular or beta estimate easily.

The formula to calculate an estimate with a triangular distribution is:

Mean = (Optimistic + Most-likely + Pessimist)/3

Or,

Expected Duration (Triangular Distribution) te= (to + tm + tp)/3

The formula to calculate an estimate with PERT (beta distribution) is:

Mean = (Optimistic + 4*Most-likely + Pessimist)/3

Expected Duration (Beta Distribution) te= (to + 4tm + tp)/6

Example-I

Your team member told you that in your project, an activity may take 18 days to complete. However, if the weather is not favorable, it will take 24 days. He also told you that if all conditions are good, the activity can be completed in 15 days.

Using a triangular distribution, calculate the expected duration for this activity.

According to the triangular estimate,

Expected Duration te= (to + tm + tp)/3

Given Data:

tm = 18 days

tp = 24 days

to = 15 days

Therefore, expected duration = (18 + 24 +15)/3

= 19 days

Example-II

Usually, an activity takes 20 days to complete. If the conditions are bad, this activity can take about 22 days. However, if all conditions are favorable, this activity can be completed in 15 days.

Using PERT, calculate the three-point estimate.

We know the PERT estimate formula:

te= (to + 4tm + tp)/6

Here:

te = PERT Estimate= to be calculated

to = Optimistic Time = 15 days

tm = Most Likely Time = 20 days

tp = Pessimistic Time = 22 days

Substituting these values into the PERT formula:

te= (to + 4tm + tp)/6

= (15 + 4*20 + 22)/6

= (15 + 80 + 22)/6

= 117/6

= 19.5 days.

Hence the PERT estimate for this activity is 19.5 days.

Critical Path

I have written a detailed blog post explaining critical path concepts and calculations. You can read it by clicking the following link.

Total and Free Float

Like critical path, you can click the following link to learn more about total float and free float.

Summary

If you understand these formulas and examples, you can solve most formula-based questions on the PMP exam. You can make a printout of this blog post or create your short notes based on this blog post and revise them during your free time. Scoring points in this area is easier than in other sections if you understand the logic and steps taken to solve the questions.

If you want to learn all the mathematical formulas for the PMP exam, you can try my PMP Formula Guide, which provides more examples and practice questions.

I took the exam in December, and there are no longer any formula-based questions.

The PMP exam is unique for each aspirant however this is the first time I heard there was no formula based question in the PMP exam.