Organizations use a retrenchment strategy when they face financial issues or have issues with managing operations. This strategy helps them cut their losses and focus on their core strengths.

This strategy often responds to declining profits, market changes, or high competition. By implementing retrenchment, businesses aim to become leaner, more efficient, and better positioned for future growth.

What is a Retrenchment Strategy?

A retrenchment strategy helps an organization reduce operations or cut expenses to achieve financial stability. Businesses often adopt this strategy during economic downturns, financial losses, or legal issues.

It aims to control costs and improve efficiency. Retrenchment can involve downsizing the workforce, closing unprofitable divisions, or selling assets. Companies may also restructure to focus on core activities.

This approach helps organizations survive difficult times, regain balance, and prepare for future growth. It is a practical tool for long-term stability.

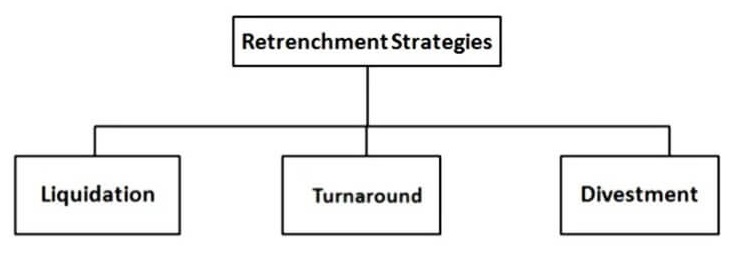

Types of Retrenchment Strategies

Retrenchment strategies can be of three types:

1. Liquidation

Liquidation is selling off a company’s assets or closing a business unit to settle debts or reduce losses. It is considered the most extreme form of retrenchment strategy because it leads to losing business, employment opportunities, and brand recognition.

Companies resort to liquidation due to persistent financial losses, poor management, unstable political conditions, corporate conflicts, or other insurmountable challenges. While liquidation results in the closure of operations, it can be necessary to prevent further financial damage.

2. Turnaround

Turnaround focuses on correcting past mistakes or poor decisions to transform a loss-making business unit into a profitable one. Often, companies neglect certain operations or units, allowing them to fall into financial trouble. When they recognize these errors, they implement a turnaround retrenchment strategy to address inefficiencies, streamline operations, and revitalize the troubled unit.

This strategy often involves restructuring, cost-cutting, and process improvements, enabling the business to regain profitability and competitiveness.

3. Divestment

Divestment involves downsizing operations or selling non-core business units to concentrate resources on the organization’s primary objectives. Unlike liquidation, divestment focuses on strategic realignment rather than closure. The money obtained from selling non-essential assets or units is reinvested in growing the core business.

This approach enables organizations to optimize performance, strengthen their market position, and invest in areas with higher growth potential while exiting less profitable ventures.

When a Business Should Use Retrenchment Strategy?

A business should consider using a retrenchment strategy when faced with the following situations:

- Continuous Financial Losses: When a company experiences consistent losses and cannot maintain profitability, retrenchment may be necessary to stop further financial decline.

- Economic Downturn: In periods of economic recession or when market conditions worsen, a retrenchment strategy helps cut costs and stabilize the business.

- Declining Market Share: When a business’s market share is shrinking due to increasing competition, retrenchment can help refocus on core strengths and improve efficiency.

- Poor Management or Inefficiency: If ineffective management or operational inefficiencies are causing underperformance, retrenchment can be used to restructure or downsize and streamline operations.

- Legal or Regulatory Issues: When a business faces legal troubles, compliance challenges, or regulatory changes that threaten its survival, retrenchment helps the business cut non-profitable areas and focus on essential operations.

- Inability to Compete: If the business cannot effectively compete in specific markets or sectors, retrenchment might involve exiting these areas and redirecting resources elsewhere.

- Overexpansion: If a company has overextended itself or spread too thin, retrenchment helps refocus on the most profitable areas to optimize resources and strengthen the core business.

Examples of Retrenchment Strategy

I will provide three examples of retrenchment strategies:

1. Liquidation Strategy

A hotel chain was experiencing losses in its restaurant business, so they decided to sell off the restaurant operations and focus solely on their hotel services. To handle food and beverage needs, they began outsourcing these services to third-party providers.

This is an example of a liquidation strategy, where a business eliminates a loss-making unit to minimize further financial harm.

2. Turnaround Strategy

In 1985, after Steve Jobs was ousted from Apple, the company began to lose its market position. However, when Jobs returned in 1997, he implemented a turnaround strategy that revived the company’s growth.

By restructuring operations, introducing innovative products, and refocusing on core strengths, Apple turned its fortunes around and became the world’s leading tech company.

3. Divestment Strategy

An organization had three separate business operations with varying levels of return on investment (ROI): 20%, 15%, and 5%. Seeing low returns from the third operation, the company decided to sell it and reinvest the proceeds to support the growth of the more profitable first operation.

This is an example of a divestment strategy, where a company sells off a non-core business unit to strengthen and grow its primary business.

Step by Step Process of Using Retrenchment Strategy

1. Assess the Situation

The first step in applying a retrenchment strategy is to assess the company’s overall situation. This involves reviewing financial statements, performance metrics, and the external market environment to identify areas of weakness. Operational inefficiencies or non-profitable business units must be pinpointed, and the external factors like economic downturns or intense competition should also be considered.

A clear understanding of the company’s financial standing and challenges is crucial before taking any further action.

2. Define the Retrenchment Goals

Once the situation is assessed, the next step is to clearly define the goals of the retrenchment strategy. The business must set specific and measurable objectives, such as reducing costs, improving profitability, or regaining financial stability.

These goals help to focus the retrenchment efforts and ensure that the actions taken will directly address the company’s problems. Clear objectives also help in measuring the success of the strategy after implementation.

3. Identify and Select the Right Strategy

With clear goals in place, the business must select the most appropriate retrenchment strategy. Depending on the situation, options may include liquidation (selling or closing non-profitable units), turnaround (revitalizing loss-making units with a restructuring plan), or divestment (selling off non-core businesses to refocus resources).

Selecting the right strategy will depend on factors like the severity of financial difficulties, available resources, and the company’s long-term objectives.

4. Implement the Strategy

Once the right strategy is chosen, it is time to implement it. This involves executing the necessary steps for liquidation, turnaround, or divestment. It might include selling off assets, restructuring operations, laying off employees, or reallocating resources.

Effective communication with stakeholders, such as employees and investors, is vital during this phase to minimize resistance and manage expectations. Ensuring smooth implementation increases the chances of success and minimizes disruption.

5. Monitor and Adjust the Strategy

After implementation, continuous monitoring of the strategy’s progress is essential. This involves tracking key performance indicators and assessing whether the retrenchment objectives are being met. Regularly reviewing the outcomes helps identify any issues or areas needing adjustment.

If necessary, the strategy should be fine-tuned or adjusted to ensure it delivers the desired results. Flexibility in this phase is critical to ensure long-term business success after retrenchment.

Summary

Retrenchment strategies play a crucial role in preventing organizations from going bankrupt and paving the way for growth. The liquidation strategy helps businesses cut costs by eliminating underperforming units. On the other hand, divestment and turnaround strategies focus on growing operations by selling non-core assets or restructuring loss-making units.

By choosing the right approach, companies can enhance efficiency, regain stability, and improve their chances of long-term success.