NIKE Inc., an American multinational corporation, is a global footwear, equipment, and apparel manufacturer. It is one of the biggest sellers of athletic shoes and is present in over 170 countries.

Conducting a SWOT analysis on Nike will help understand the business’ key performing areas and segments that need improvement. In addition, it will determine the success factors of Nike and what gives it a competitive and comparative advantage in the market.

Before discussing Nike’s SWOT analysis, let us know the background of Nike.

Bill Bowerman and Phil Knight founded Nike in 1964 in Sweden. Nike’s home base is in the metropolitan region of Portland near Beaverton, Oregon. Nike’s swoosh logo is one of the most recognized logos in the world and is the wing of the Greek goddess of victory. The logo symbolizes movement, speed, motivation, and power.

Their vision is to see a world united in the joy of movement and being an athlete. It focuses on bringing innovative and inspiring designs suiting every athlete.

Questions to Consider Before Conducting SWOT Analysis.

Figuring Out the Strengths

- What all assets does the business own?

- What is the key performing asset for the business?

- How is the business different from its competitors?

- What substitutes of the product/services exist in the market?

- Does the business have a competitive advantage already?

- What unique resources does the business use?

- What is the business’s USP?

- How big is the business’s target market/clientele?

- Are there any exclusive relationships with suppliers/distributors?

- How strong is the business’ sales/marketing team?

- How is the business’ workforce better?

- Does the business have access to additional capital?

- What is the one thing customers love about the business?

Figuring Out the Weaknesses

- What are the areas in which business needs improvement?

- What expertise does the business need to garner?

- What are the additional costs that the business bears?

- How are competitors better?

- Is the customer base diversified or not?

- Does the business have any debt?

- What are the regular complaints customers have?

- Are there any business objections or legal issues?

- Does the business have advanced equipment and technology?

- Is the business understaffed?

- Is there any cash flow issue?

- What is the profit margin of the business compared to competitors?

Figuring Out the Opportunities

- What are the current trends affecting the business?

- Is the business able to perform as per the market?

- Are there new talents available to hire?

- Can the business better itself when compared to competitors?

- Is the target market dynamic?

- Is there any unfulfilled need in the industry that businesses can fill?

- Is the business targeting a niche market?

- What more can the business offer?

Figuring Out the Threats

- Is there any direct competitor for the business?

- Is the business prepared for a crisis?

- Are the employees satisfied?

- Are customers truly happy with the products/services?

- Does the business have enough materials/supplies?

- Is the business’ website secure?

- Are competitors going to expand their product/service line?

- Is the customer base shrinking?

- Is the business ready for a market trend change?

SWOT Analysis of Nike

Let’s start with the SWOT analysis of NIKE.

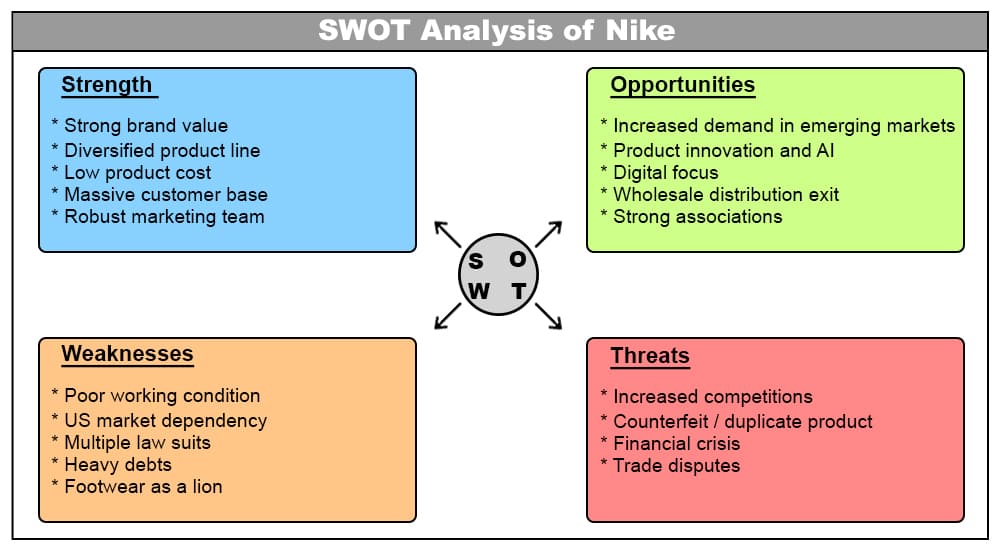

Strengths

1- Strong Brand Value

Nike has strong brand value and awareness in the market. As of 2022, it has a brand value of over 146 billion US dollars. Its logo and tagline, “just do it” is the most recognizable brand in the market. In addition, the easy-to-pronounce and unique name make it a strong core brand.

2- Diversified Product Line

Nike is best known for its footwear but also has a clothing line. Additionally, the business maintains side brands like Converse and Hurley. Its sub-brands like Nike Blazers, Tiempo, and Shox add to its profitability and revenue. Nike maintains a diversified brand portfolio.

3- Low Production Cost

Nike holds a substantial margin in its products because most of its manufacturing happens in low-labor-cost countries. These countries include Vietnam, China, and Indonesia, producing most of Nike’s footwear. Other countries like Italy, India, Brazil, Mexico, and Argentina also successfully contribute to Nike’s product production at a low cost.

4- Massive Customer Base

Nike has a solid customer base across the globe. From people in America and India to Europe and other parts of the world – Nike is one of the most likable brands in footwear. The customer base is loyal, and it is difficult for them to shift to another competitor due to the comfort and quality of Nike products.

Nike’s popularity has increased its market cap to over 146 billion USD as of 2022. This is way above its competitors like Adidas ($19.14 billion), Puma ($6.78 billion), Skechers ($5.19 billion), etc.

5- Robust Marketing Team

Nike has one of the strongest marketing teams in the industry. However, its incredible market campaigns create a fear of missing out on customers, And the business focuses on demand creation through heavy advertising, endorsements, incentives, and promotions.

It also focuses on getting a handful of the same product at once and does not quickly restock the item. This creates a demand-supply mismatch that urges customers to get their hands on the product before it gets out of the market. Nike spends over 3 billion USD annually on marketing campaigns to reach more customers.

Weaknesses

1- Poor Working Conditions

Nike has the most manufacturing units in developing countries like India, Vietnam, Brazil, Mexico, etc., because these countries’ labor costs are cheap. However, there has been heavy criticism about the working conditions being deplorable.

Over the last two decades, Nike has had accusations of utilizing child labor, giving below minimum wages, unsafe working environments, and more. The labor exploitation in the business is appalling.

2- US Market Dependency

Nike depends on the American market for its sales because about 40% of their sales come from the Northern part of America. Hence, even after its global popularity, the business substantially relies on the US market for growth, profits, and revenue. Also, the dependency on one country makes it challenging for the business to establish a well-balanced customer base.

3- Multiple Lawsuits

Nike is facing several lawsuits year after year. So, this causes a legal downturn in the company and hampers its goodwill and brand. Some of its lawsuits include an employee accusing the business of discrimination against females, a toxic company culture, violation of the equal pay act, and more.

4- Heavy Debts

Nike as a business has been facing financial threats for quite some years now. Despite its profitability, it has a floating debt of over $3,000 million rolling over every year. The business also has a long-term debt of $9.4 billion that it still needs to repay. This makes the business’s income statement unfavorable, with liabilities exceeding yearly.

5- Footwear as a Lion

Even though the business has a diversified product line, it heavily relies on its footwear. The footwear section of Nike is its lion making most of its revenues. Hence, Nike depends majorly on its footwear products for market survival.

During times of crisis, a dependency on one line of products makes it difficult for the company to survive successfully. Hence Nike needs to have horizontal and vertical diversification in products.

Opportunities

1- Increasing Demand in Emerging Markets

Several developing countries are emerging markets for Nike. Countries like China, Brazil, and India are seeing a surge in demand for Nike products. In addition, the footwear range of the business, especially the Air Jordans, has seen a flourishing demand over the last few years. This builds several opportunities for the business to operate in these countries and increase its customer base.

2- Product Innovation and AI

Nike has started using advanced technologies for product innovation. It is now building wearable technology that helps in monitoring physical activities. Most of its product innovation right now is related to health and witness. Combining this with sports can be a significant opportunity for Nike to gain a first-mover advantage in the market.

Additionally, it has started acquiring AI start-ups like the predictive analytics platform Select and the metaverse merger with RTFKT. This will help Nike expand its online sales capacities, shopping behavior prediction, and in-game merchandising.

3- Digital Focus

Nike has shifted to a direct customer strategy, focusing more on shifting digital and closing its physical stores. This decision was taken after the business witnessed around 39% of its revenue from online sales. Doing this will help Nike cut costs by closing physical outlets and reaching customers faster.

4- Wholesale Distribution Exit

Nike has announced the exit from all its wholesale distribution channels in the US. Nike now only sells its products in its online and offline stores. The exit from wholesale distribution has increased its profit margins because the products will now exclusively be available on only the business’ platform.

This allows Nike to control prices and enhance customers’ shopping experience.

5- Strong Associations

Nike already has strong associations through contracts with worldwide celebrities. This provides the business with growth opportunities. Nike can do this by bringing more accessories and fashion products into the market and expanding its business.

Threats

1- Increased Competition

With the increasing competition in the sports industry, Nike has to spend more on marketing every year. In 2020 alone, Nike spent over $3.5 billion on-demand generation. As a result, Nike feels pressured to do more every year to stand out from the competition and attract customers. It also focuses on developing innovative products that help the business gain a competitive advantage in the market.

2- Counterfeit/Duplicate Products

Since the company trades globally and has worldwide recognition, more and more resellers are entering the market to produce duplicate Nike products. These products are of cheap quality and sold at dirt-low prices.

However, Nike’s revenue, brand value, and reputation are affected since they look exactly like the originals. In addition, many merchandisers and retailers also counterfeit these cheap products and sell them at a lower rate, which damages Nike’s image and gives an impression to customers that Nike has inferior quality products. s

3- Economic and Financial Crisis

Economic and financial crises followed by events like the 2019 pandemic impacted Nike’s business heavily. The global recession makes the business vulnerable to losses. In 2020, Nike witnessed a 38% decline in sales in a single quarter and expected further declines.

Even now, with the prevailing recession, Nike’s business is impacted as people focus more on necessities like food and shelter than on luxuries like footwear.

4- Trade Dispute

Nike is a global brand that trades its products across the globe. It depends on many markets, so the trade lines affect Nike’s business. Recent trade tensions are going on between China and the US, which could turn unfavorable for Nike. This will result in a drop in Nike’s sales if the trade war escalates and could lead to hefty losses for the business.

Final Thoughts

Nike’s SWOT analysis clearly shows that the business is doing well in the market. Even though there exist some threats and significant weaknesses in the business, its profitability is intact. It is the biggest footwear brand in the world and cashes multiple billions of US dollars every year.

However, since it heavily depends on the US market, it must watch out for non-diversification threats. It has several opportunities to grow its business in and out of America. On the other hand, as a business, Nike can improve its product quality and outsourcing services. The business has had a gross profit running for several years now and holds a significant market share and position in its industry.