Resources are limited, so businesses must make the right decision to use available resources. Furthermore, to define the basis of economic decision-making, it is crucial to consider a specific rate of return (ROR) so that its capital achieves a return on operations; we call this the cost of capital.

A project’s internal rate of return (IRR) is its expected return on investment. In other words, IRR is the discount rate that will make the present value of the expected cash inflows equal to the cost of capital and the NPV equal to zero.

A firm expects to accept projects with an IRR greater than the cost of capital and reject projects with an IRR less than the cost. Projects with an IRR equal to the cost of capital can either be accepted or rejected.

Internal Rate of Return (IRR)

IRR is a discounted cash flow technique.

Definition: The Internal Rate of Return (IRR) is the projected annual yield of an investment measured in percentage. It is the discount rate that makes the NPV equal to zero. Therefore, IRR is one of the essential tools for project assessment.

Organizations weigh the costs and benefits of investments to maintain or expand their operating capabilities. Therefore, it becomes crucial when evaluating and selecting projects.

The decision comes in many forms, from building a new facility and buying a new machine to acquiring another firm. The key question will be whether the potential return on the project justifies the initial cost and provides value to the organization. Then, the cash flow determines which projects are worthwhile.

Internal rate of return (IRR) is a financial tool used by businesses to determine the profitability of an investment based on predicted cash flows.

IRR Formula

The IRR formula is complex and relies on trial and error to get it correct.

Mathematically, we can represent the IRR as the discount rate that makes the following true:

Net investment = Sum of the present values of cash inflows.

However, because of the complexity of the calculation, the computation is done using software rather than manually.

An example of an IRR formula is below:

Where:

Ct = net cash inflow during the period t

C0 = total initial investment cost

r = discount rate

t = number of time periods

The IRR may also be the discount rate that, when applied to the cash flows of a project, produces a net present value (NPV) of zero. Therefore, this discount rate can be the forecast return for the project.

The project is accepted if the IRR exceeds a pre-set percentage target (the cost of capital). If less, the project is rejected.

Calculating the Internal Rate of Return

You can determine the IRR can by solving for r in the earlier equation.

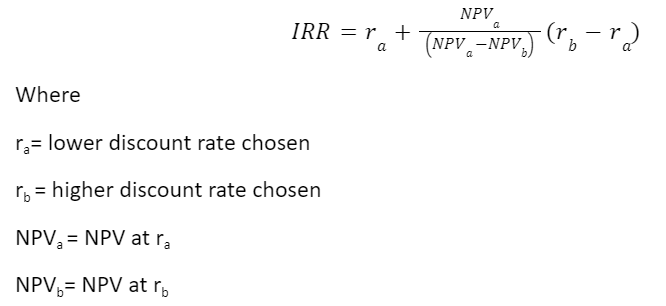

However, there is a short-cut formula to calculate the IRR of a given project. An example is below:

To use the formula, analysts take the project’s cash flows and discount them twice – once using a discount rate a%, and once using a discount rate b%. This is a trial-and-error method whereby the estimation is most accurate if one NPV used in the formula is positive and the other one is negative.

Example of IRR

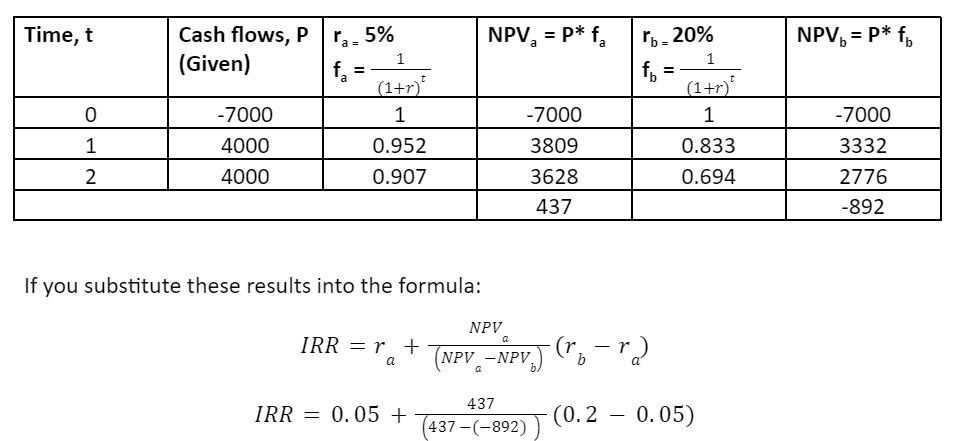

Let’s assume that project-A has an immediate cash outflow of $7,000 and then cash inflows of $4,000 in the first and second years. The following results are gained considering the cash flows and discount them at 5% and 20%.

IRR= 0.05 + 0.3288(0.15)

IRR= 0.099

Thus, the IRR is estimated to be 9.9%, which is the project’s expected return. If the target return were 6%, they would accept the project; if the target return were 15%, they would reject it.

Relevance of the Internal Rate of Return

- It provides a metric to compare to the company’s cost of capital

- It is a means to get a stakeholder’s support for a project.

- In addition to NPV, stakeholders can see the viability of a potential investment.

- It is useful for projects with a conventional cash flow pattern, with an initial cash outflow followed by a series of cash inflows.

- You would mainly use this in project selection, feasibility studies, or planning studies for large projects. p

- It can help establish whether new projects will be more profitable than expanding existing projects.

- It is a uniform calculation for investments to rank different projects.

Limitations of Internal Rate of Return

- It is not an effective metric when comparing projects with different durations because shorter-duration projects often have a high IRR. Conversely, projects with a long duration may have a low IRR.

- There may be instances where required data are unavailable.

- If the sign on a project’s cash flows changes more than once (for example, if it has a disposal cost at the end of its life), the project can have multiple IRRs producing another discount rate at which the NPV is zero. To correct this, you use the MIRR (Modified Internal Rate of Return where all negative and positive cash flows give a more realistic IRR.

- You cannot use it for non-tangible (non-monetary) value investments such as road construction or environmental remediation. In such cases, a cost-benefit analysis is more appropriate.

Conclusion

The IRR uses cash flows, which are real, rather than profits, or where you can manipulate them. It gives a result that is easy for management to understand and interpret. With the time value of money under consideration, IRR is a profitability measure with a clear acceptance rule. Therefore, it is a theoretically sound investment evaluation criterion focusing on the shareholders’ value.